Topic

B2B Commerce

Published

December 2022

Reading time

10 minutes

Check this Out - Part 2

A Deep Dive on Checkout Challengers

Authors

Check this Out - Part 2

Download ReportResearch

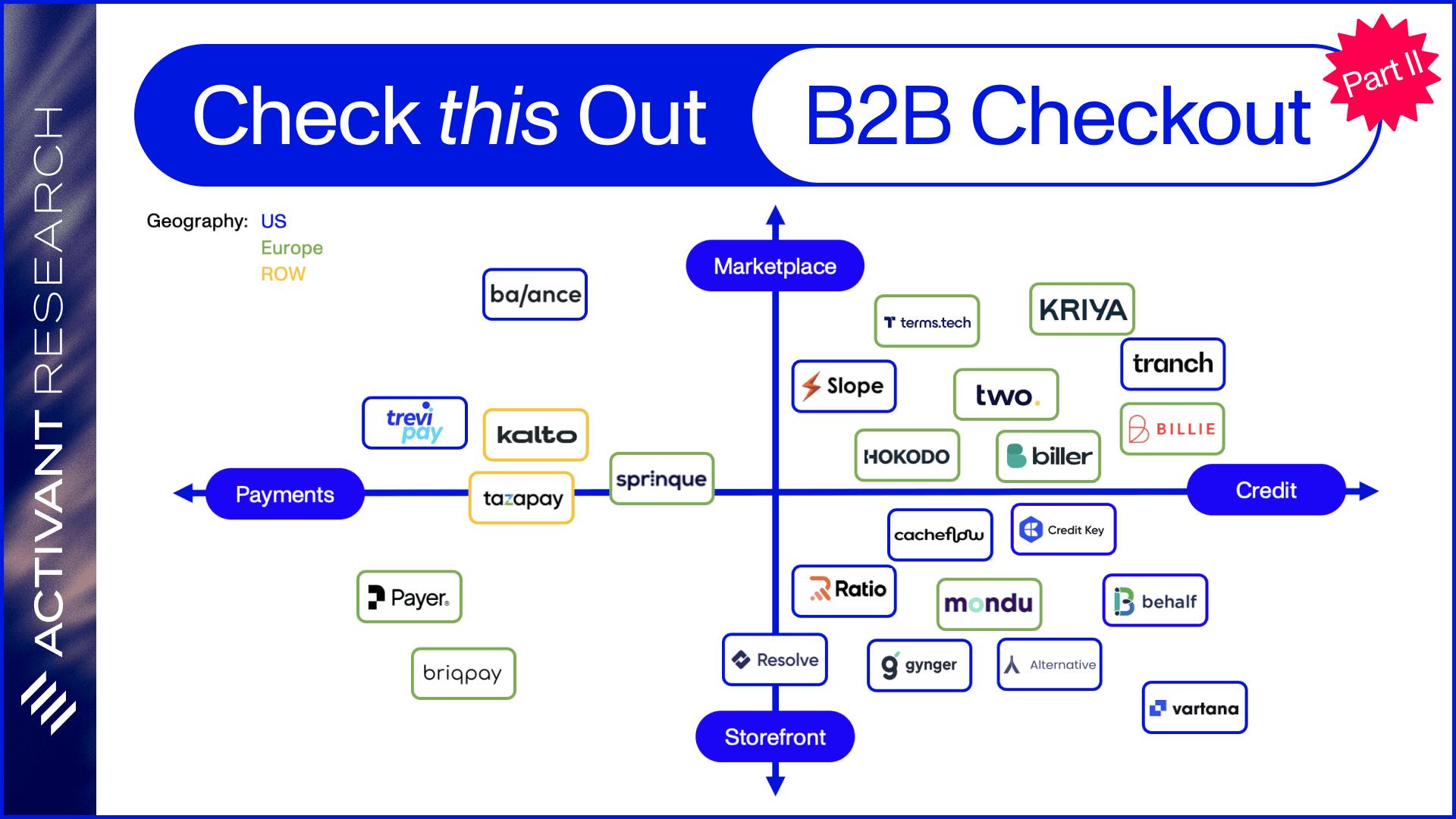

The B2B checkout universe in the midst of a Cambrian explosion. We’ve identified 19 players in our market map; the median founding date of which is just 2020. It’s clear why so many companies are emerging so quickly; the pain is real, and the opportunity to solve it is huge. Catch up on why in Part I here.

Market Map

B2B Checkout

Our market map is a work-in-progress. If you have thoughts or disagree with our perspective, we want to hear it.

These companies are all racing to build a scaled B2B checkout player. Each team is taking their approach to the product and go-to-market within the context of their geography and end-user profile. But ultimately, we see two distinct approaches, highlighted on the X Axis:

- Optimizing for distribution with a credit product as the primary value proposition (think B2B BNPL). These solutions tend to sit in a merchant’s existing checkout flow alongside other payment options.

- Pros: Speed to market, complementary rather than rip and replace

- Cons: Company’s product is one of multiple options in checkout flow (for now)

- Optimizing to own more of the payment stack by building a deeper product. These companies tend to handle the flow of funds – and thus risk – themselves. They aim to provide a one-stop-shop for merchants, with many ways to pay (credit, ACH, wire transfer, BNPL) from a single provider, and enterprise-grade features like escrow accounts, cross-border support, and trade insurance.

- Pros: Support all of a merchant’s ecommerce payments, especially larger customers with more complex needs.

- Cons: Slower speed-to-market, must potentially displace a merchant’s existing PSP (payment service provider) in order to own all of checkout.

This is a classic trade-off in the world of rapidly scaling companies. The traditional playbook in fintech over the last decade has been to develop an initial product, win customers and thus distribution, and use that footing as a beachhead to roll out a broader suite of products. But in a rapidly changing macroeconomic market, product depth arguably matters more than ever. While digital B2B commerce is growing – and is a decades-long trend – in today’s market, every vendor relationship will come under scrutiny. No one is immune. Ensuring that your product is a need-to-have, not a nice-to-have, is critical.

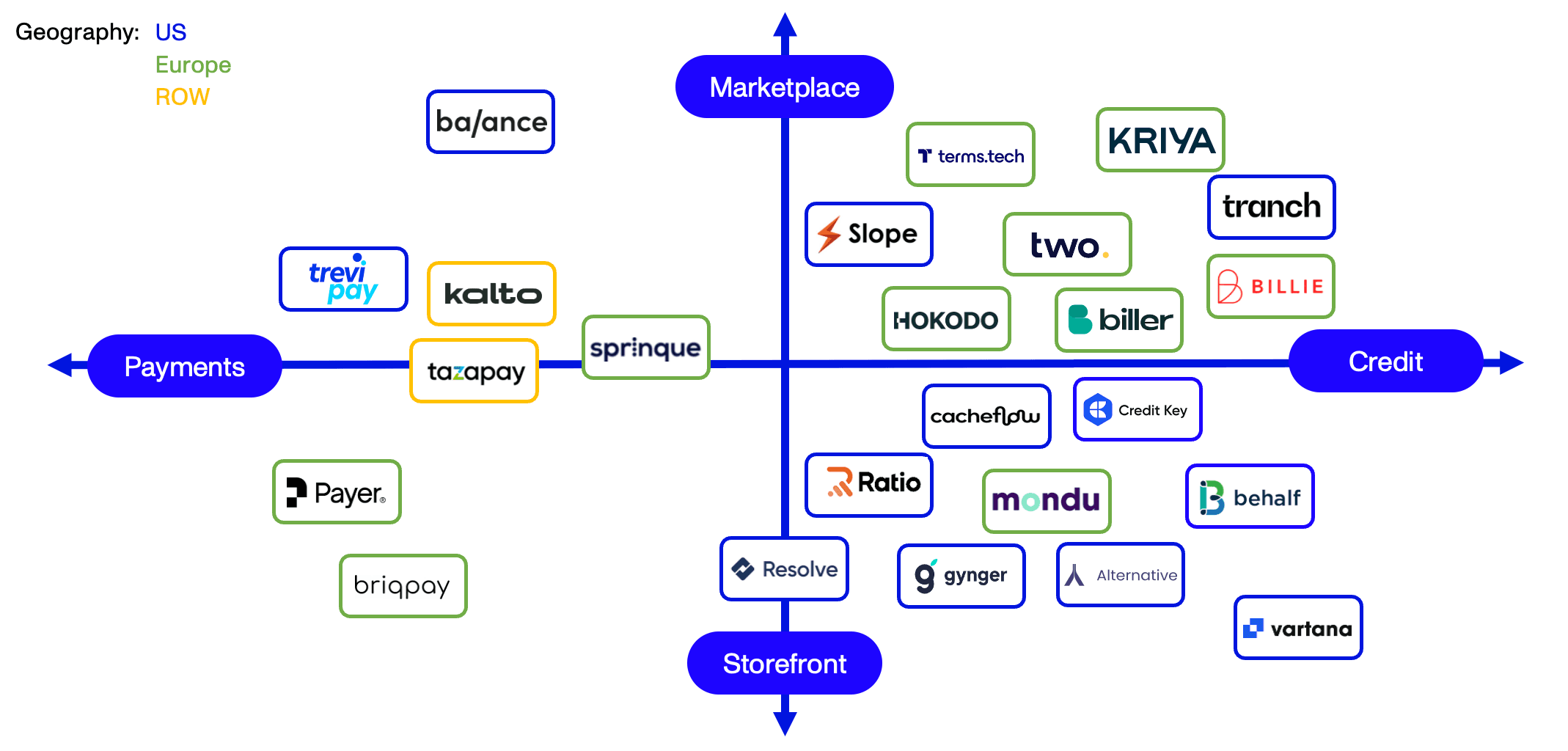

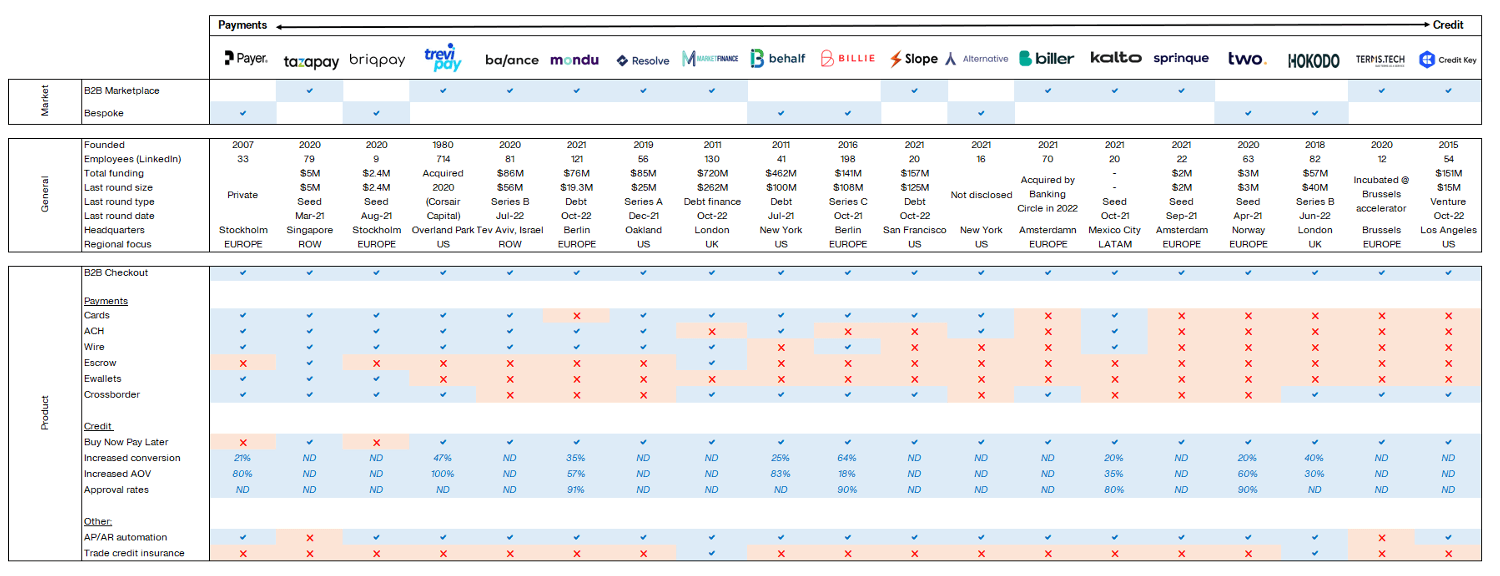

Feature Spectrum

Each company's feature set reflects their strategy, and where they fall on the spectrum between the distribution-biased credit angle and the product-rich payment approach:

Feature Table

B2B Checkout

Highlighting the Challengers

United States

In the U.S., San Francisco-based Slope is focused on delivering a consumer-grade BNPL solution for B2B customers. They have an emphasis on machine learning to deliver fast underwriting of buyers at the point of purchase. While their team’s background is serious – rooted in deep learning for self-driving cars – they keep it casual with a no shoes in the office policy.

Balance aims to build the full checkout stack with a go-to-market focus on powering the upcoming generation of digital marketplaces; on marketplaces, it’s especially important to have a seamless experience, as counterparties are discovering and transacting for the first time.

Credit Key’s approach is in their name. Their credit-forward solution offers up to 12-month terms, a unique value prop in the space. This blurs the line between a transaction-based loan (BNPL), and a term loan. We’re excited to cover this nuance more in an upcoming report on embedded lending.

Resolve was spun out of consumer BNPL giant Affirm in 2019, and naturally takes a credit-led approach as well. This raises an interesting question – why didn’t Affirm build B2B BNPL themselves? With a strong consumer brand and low cost of capital, they appear well positioned to do so. We can only speculate as the exact reasoning – but from our perspective, it’s down to the customer experience. While the experience to the user might feel similar, the underlying product requirements are sufficiently different.

Customer Profile: Notch Ordering

Notch is disrupting wholesale food service, the backbone of restaurants around the globe, with a B2B commerce platform that brings ordering, invoices, communication, and payments online:

Running a restaurant is hard work, and currently restaurant managers are living on decades-old tech. Inefficiencies in ordering can be the difference of breaking a profit or going under. B2B checkout sits at the center of our ecosystem, unlocking payments and financial services for the thousands of restaurants on our platform.

Jordan Huck, Founder & CEO, Notch Ordering

Europe

Across the Atlantic, Berlin-based Billie announced a major partnership with Klarna last year. Klarna will make Billie’s B2B BNPL product available to its base of 250,000 businesses to use for their supplier and vendor transactions. This unlocks distribution for Billie and a deeper product suite for Klarna and its merchants.

The European market presents its own challenges and opportunities. With so many countries, currencies, governing bodies, and regional payment methods, scaling across the continent is a challenge. But mastering the complexity of Europe often prepares companies well for broader international expansion, as they’ve dealt with the challenges of internationalization (regulation, language translation, regional nuances) and fiscalization (ensuring tax reporting and compliance for payment) and ready to compete on the global stage.

One of the benefits for checkout startups building in Europe is the high adoption of open banking platforms in the region, like SEPA, which allow for easy API connections to financial institutions and promote low cost and rapid money transfers directly between bank accounts. Often in the U.S., consumers and businesses are forced to make a trade on digital transactions: optimize for speed on card rails (with an associated 3% transaction fee), or low cost on via ACH, (with an associated 3-day wait). In Europe, users don’t have to make this trade, at least as often as they do in the U.S. This not only provides a better checkout experience to business customers but presents a more attractive potential margin profile for European checkout platforms. Activant portfolio company Sardine is working to introduce faster, lower cost payments in the U.S. -

Data – specifically business information data – is more widely available in Europe, notably in the Nordics. Oslo-based Two and Stockholm-based Payer, can access publicly government databases for business information. This means their product can pre-fill forms and more quickly verify businesses, which leads to a faster checkout. Contrast that with the U.S., where municipal business data lives in thousands of filing cabinets across the country. Business identity infrastructure providers like Middesk are working on changing that.

Policy-Led Protocols

Governments around the world are using policy to advance modern payment protocols. From the aforementioned SEPA in Europe, to RTP in the U.S., to UPI in India, and PIX in Brazil – the list goes on. Their common goal is to reduce cost, increase speed, and drive digitization of payments to encourage trade and economic growth. They have the added benefit of introducing traceability, which especially for cash-dominated economies like India, can bolster income and sales tax compliance. But why does this matter for checkout players? These policies present the opportunity to ride the tailwind of nationwide digital payments adoption, which are especially powerful in developing markets.

LatAm

In regions like LatAm, where Kalto is focused, card adoption is low (17%), fraud rates are high (2-5%), leading to 50%-70% acceptance transaction acceptance rates. But digital commerce is still growing at 18% CAGR through 2025; imagine how fast it would grow if checkout was a solved problem! Note that Activant portfolio company

Orchestration

B2B payment flows get complicated, especially for larger merchants that have operations in multiple geographies, with many bank accounts, holding various currencies, which are moved across a series of rails. It’s a multifactorial optimization problem. If founders want to build the perfect checkout platform, they will need payments orchestration to do so. Activant portfolio company is working on this -

Trade Credit Insurance

B2B transactions are large, not just the transaction size, but often the physical size too. Imagine the complexities involved in moving two dozen 10-foot-tall industrial steel coils from a mill in the U.S. to an auto factory in Germany. Plenty can go wrong along the way. Transactions of this dollar and physical size are an exercise in risk management, for which trade credit insurance is a useful tool. This provides protection to a business in the case that its customers fail to pay, whether due to cash flow issues, insolvency, or regional instability. Checkout platforms like Hokodo and Kriya offer trade credit insurance as a feature within their product flow, while Bondaval offers it to merchants as-a-service.

Cross-Border

The U.S. alone imports $3 trillion worth of goods,2 whilst 25% (or $25 trillion) of all B2B payment flows are cross-border. International transactions, like our steel example, are as complicated as it gets. They involve cross-border payments, sophisticated logistics, and and escrow accounts. We have seen this firsthand, working on payment solutions with our portfolio company Tridge, a global vertical B2B marketplace for food and agriculture based in Korea. Based in Singapore, Tazapay’s mission is to enable digital international payments; checkout is just one features within their product suite that spans across escrow and treasury management. Founded by former Stripe and PayPal veterans, Tazapay is empowering sellers across 173+ countries.

2) U.S. Department of Commerce

Taking Stock

Let's step back: B2B Commerce is a $100+ trillion market that is in the rapid process of digitizing. While there's plenty of challengers, we believe opportunity set is massive and the market can support many large winners. We're excited to watch the market evolve; if you're working in the space, please get in touch.

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.