Topic

Supply Chain & Logistics

Published

December 2022

Reading time

14 minutes

Every Company Will Be a Logistics Company

A key lesson from the last few years of pandemic life is that every company needs to start thinking like a logistics company, even become one themselves

Every Company Will Be a Logistics Company

Download ReportResearch

Dear CEOs of logistics companies, it’s now up to you to spread the word, to help your merchants and ecosystem partners see the immense value of logistics and embrace it as a source of competitive advantage. Each one needs to start thinking like a logistics company and place their supply chain front and center in their strategic roadmaps:

- They must digitize their supply chain data and workflows and bring them into the cloud. They must use SaaS software, or they will fail to be competitive.

- They must strengthen supply chain planning and inventory management. They must replace just-in-time with just-in-case and other alternatives to ensure resilience.

- They must have a strategy for supply chain visibility, as real-time monitoring prevents the shock of disruption.

- They must have a strategy for last-mile delivery (which accounts for 53% of logistics costs) as the world now expects faster and greater convenience.

- They must have a strategy for automation as labor costs continue to rise while robotic solutions evolve and get cheaper.

Big retailers have already seen this, and are adapting …

The smartest have brought logistics in-house. Shopify bought Deliverr (an Activant portfolio company) and increasingly sees itself as a logistics company, Target continues to invest in logistics and build on its acquisition of Shipt, and Walmart is expanding its delivery capabilities. Partnerships are everywhere, and 800-pound gorilla Amazon has known the value of owning the supply chain all along.

The opportunity in supply chain has never been greater…

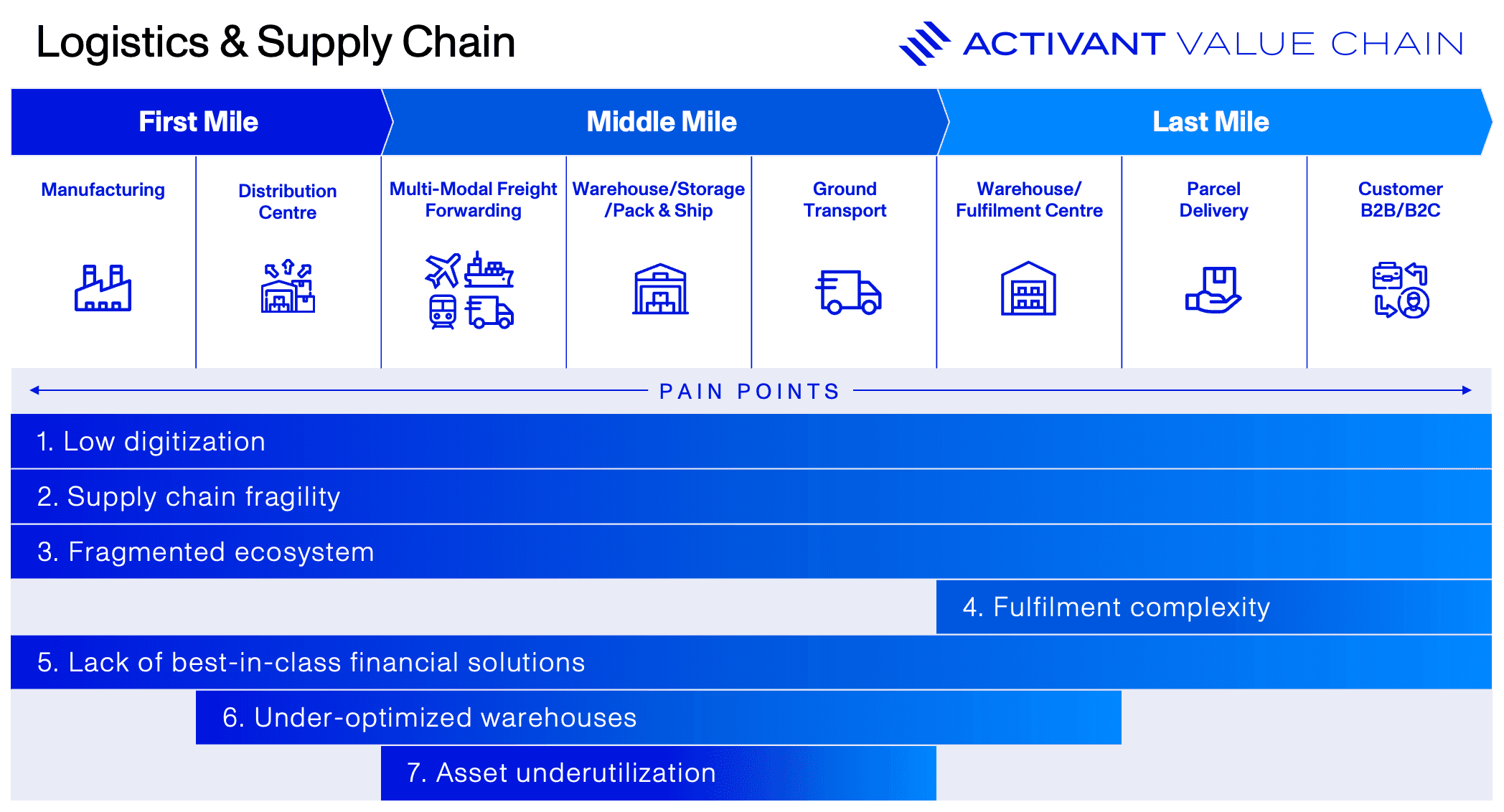

At Activant we have spent the last five years deep in supply chain and logistics. The pandemic exposed just how impactful and present the pain points in supply chain are. We believe the lack of digitization and high fragmentation contribute to overall supply chain fragility. Furthermore, we see other pain points like rising fulfillment complexity, particularly in the last mile, along with a lack of best-in-class financial solutions, woefully under-optimized warehouses and underutilized transportation assets.

The opportunity to fix these pain points and improve the supply chain has never been greater. With global logistics spending close to $11 trillion annually, we believe every company needs to become a logistics company. But how? Historically, you built or manually assembled it yourself, but technology allows companies to have a better-performing supply chain for less money and lower cost. The benefit of a high-performing supply chain can be massive, with an APQC study showing supply chain costs per $1,000 of revenue at just $26 for top performers, versus $107 for bottom performers, which is a 4x cost savings.

As the world moves to address these problems, we predict a future where logistics and fulfillment no longer go unnoticed in the background. Instead, we see a world where efficient supply chains and superior fulfillment become ubiquitous.

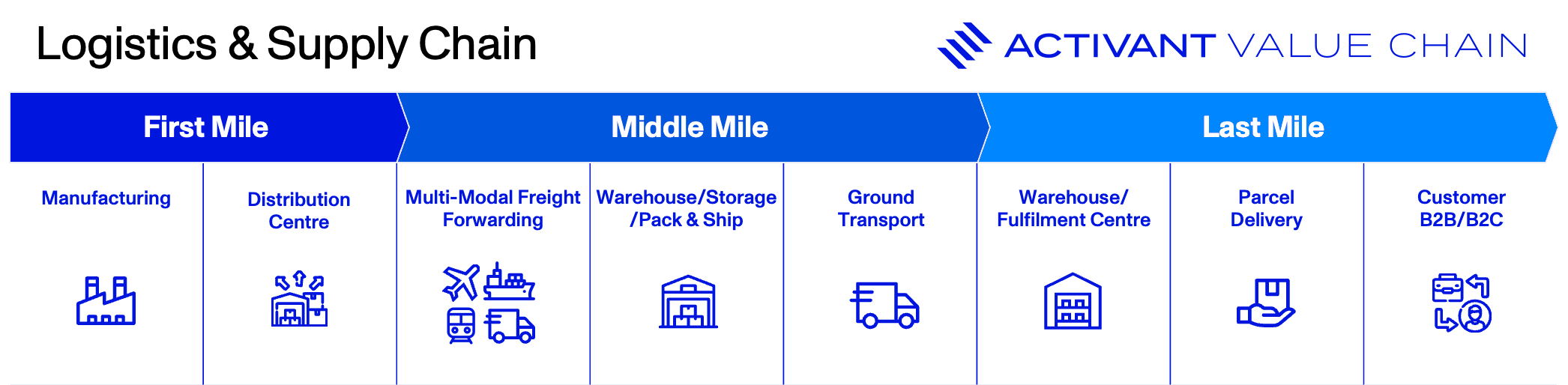

The Value Chain

To set the stage, we find it helpful to think about markets via a value chain: a framework that breaks down sectors into the major activities and the areas where potential solutions can be applied:

Simplistically, the Logistics chain can be divided into three primary components: in the First Mile, a product is moved from a manufacturer to a distribution center before being forwarded to the Middle Mile, which is where products received from multiple partners are warehoused for sorting, picking, packing, and shipping to the Last Mile, which is the final leg of the product’s journey to the customer.

What are the key pain points and how do they map against our value chain?

Not surprisingly, many of our pain points span the entire value chain. Historically, the first mile has been easy to overlook, given the limited stakeholders and distance from the final customer, but the increased need for end-to-end delivery transparency and cost minimization has seen increased investment in automation and visibility. The middle mile is quite complex due to the steps and players involved and has the most opportunity for cost savings. Unsurprisingly, almost all the pressure point fixes we consider overlap here. The last mile is where companies can influence customer buying decisions and brand loyalty, therefore demanding wide-ranging mitigation of pressure points.

What are the Opportunities?

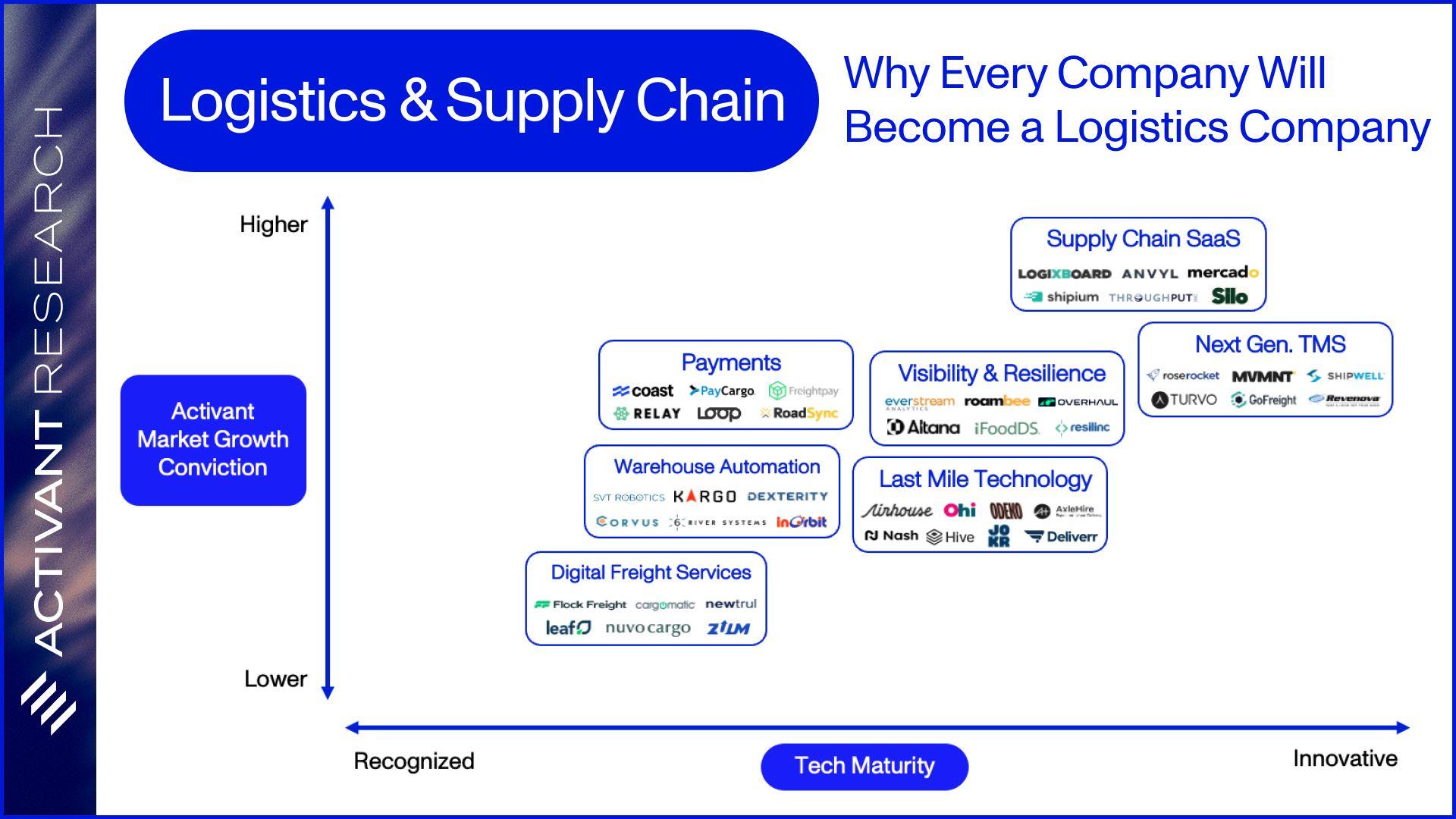

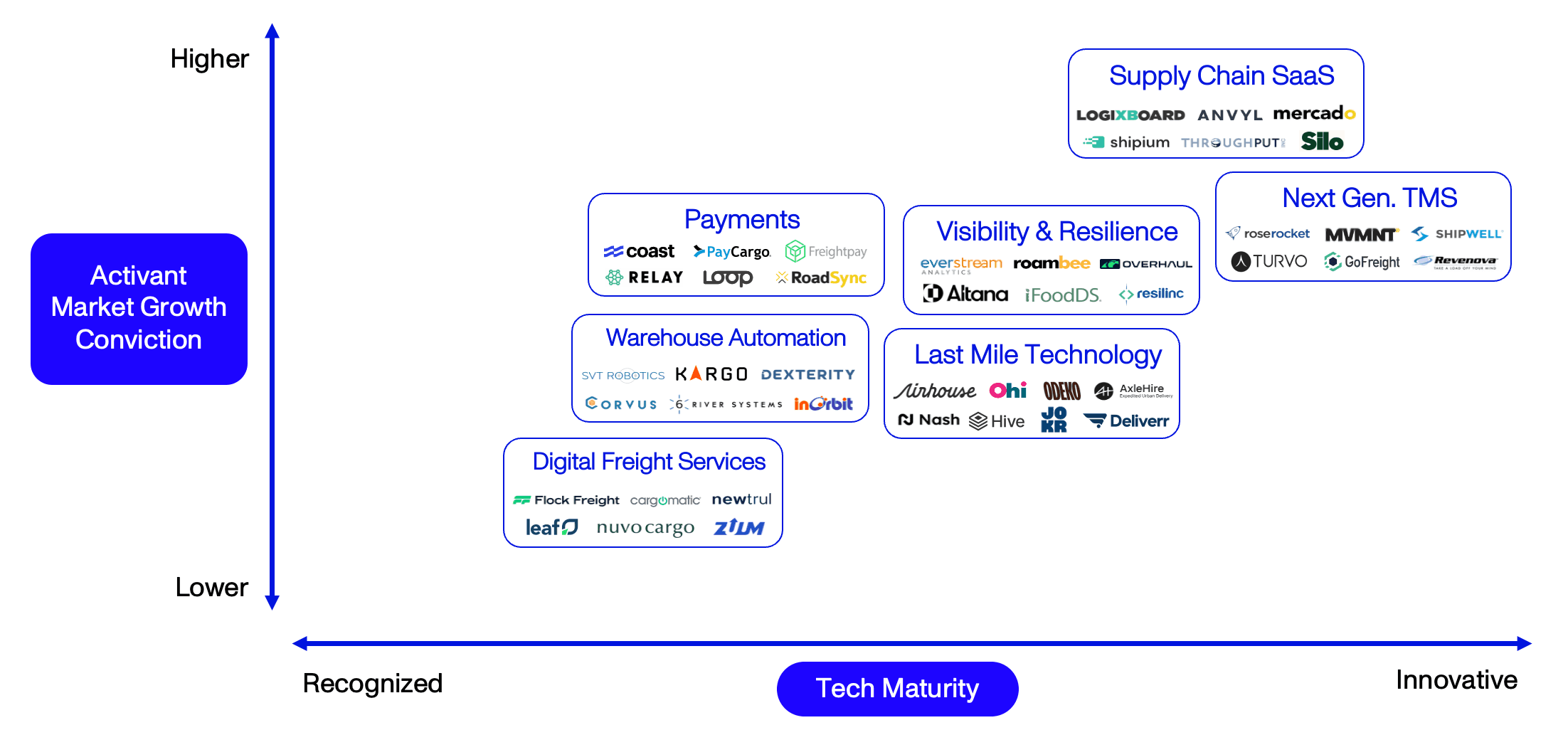

Our Activant Thesis Map lays out our current conviction and belief in the fastest growing and most innovative solution areas for these pain points in logistics. Future articles will dive deeper on individual areas.

Thesis Map

Logistics & Supply Chain

As always, our thinking is constantly evolving, and this is not exhaustive. If you disagree with our perspectives, we want to hear it! We’re going to cover many of these spaces in further detail, so if you don’t see your company here, don’t fret – this is just the tip of the iceberg.

1Digitizing the Supply Chain with SaaS

Digital services account for <4% of global logistics expenditure

Pain Point: Low Digitization

Global supply chains are vast and complex, involving multiple stakeholders using different systems and non-standardized, manual processes. An estimated 50% of the U.S.’ largest importers still use spreadsheets to manage their complex international supply chain. Nonetheless, the adoption of cloud-based software and technology to build smart connections across the supply chain is gathering pace. IBM and Celonis (an Activant portfolio company) found 72% of supply chain executives expect most of their processes and workflows to be automated in 3-5 years. That may seem like a heavy lift, but it does show serious intent and commitment!

50%

of the largest importers in the U.S. still use spreadsheets

72%

of supply chain executives expect most processes to be automated in 3-5 years

Opportunity: Supply Chain SaaS

Chain implies linkage, and supply chain SaaS seeks to provide solutions to pain points across complex supply chains. They can be niche (e.g., digitizing documentation), vertical (e.g., agriculture), horizontal (e.g., supply chain planning) or focused on specific segments or providers in the value chain (e.g., freight forwarders, ecommerce merchants). Collectively, they will drive digitization. Logixboard provides software that allows freight forwarders to digitize their offerings, leveling the field versus established digital competitors. Shipium is building a platform of supply chain tools for e-commerce merchants to make competitive delivery promises to their customers. Silo’s software connects produce growers, shippers, and distributors while enabling financial solutions.

2Fragile Supply Chains Need Better Visibility

Total cost of supply chain disruption in 2020 was $4 trillion

Pain Point: Supply Chain Fragility

The last three years alone have seen major supply chain disruptions due to pandemic-related shutdowns, geopolitics, cyber-attacks and weather extremes. This vulnerability is a function of increasingly complex global supply chains. Traditional fixes rely on manual processes and are just focused on individual pain points. Modern solutions need to provide real-time, end-to-end visibility of the supply chain to anticipate and plan for future disruptions. The need is real, with 77% of companies planning to invest more in increasing their supply chain visibility.

77%

of companies plan to invest more in increasing supply chain visibility

Opportunity: Supply Chain Visibility & Resilience

The market has moved from simply alerting customers to a problem to identifying alternatives and recommending the optimal choice. This is an evolutionary move towards ‘self-sustaining’ or ‘self-healing’ supply chains. The wider visibility ecosystem includes established incumbents, who offer entire life-cycle visibility for goods in transit. There are also exciting emerging providers like Altana, whose machine-learning algorithms are systematically mapping global supply chains to establish a central source of truth; iFoodDS, a leader in food security and traceability; and Everstream Analytics, which evaluates a company’s partner risk, as well as externalities like weather and cybersecurity.

3TMS is the Key to Orchestrating a Fragmented Ecosystem

As high as 85% of shippers don’t have a Transportation Management System

Pain Point: Fragmented Ecosystem

U.S. logistics is highly fragmented, with over 3 million transportation & warehousing businesses. Complexity increases with over 35m businesses, 13m trucks, 1.8m carriers, 90k brokers/agents, and over half a million general warehouses. Large legacy TMS providers started more than three decades ago, but the industry’s adoption still lags.

Opportunity: Next-Generation TMS

In addition to basic planning and execution, modern TMS’s enrich the offering to include things like visibility, exception management, payments, and data analytics. Activant portfolio company Turvo’s (now part of Lineage Logistics) SaaS cloud offering breaks down the walls between different stakeholders and their systems and improves collaboration. MVMNT operates as a “brokerage in a box”, providing its subscription-free platform to small and mid-sized businesses while also offering embedded financing solutions. Rose Rocket’s platform lets trucking companies unlock and match capacity with their drivers, customers, and logistics partners via an enhanced networked portal.

4Last-Mile Solutions Overcome E-Com Fulfillment Hurdles

55% of consumers say 2-hour delivery would increase their loyalty, but only 19% of companies offer it

Pain Point: Rising Fulfillment Complexity

Rising fulfillment complexity has accelerated due to the growth of ecommerce and increasing customer expectations, led by Amazon’s convenience and speed. The pressure to provide almost free, almost instantaneous delivery is intense. But last-mile delivery costs remain high (53% of the total cost of shipping) and the damage to brand and customer loyalty if not done well can be significant.

53%

of the total cost of shipping are last-mile delivery costs

Opportunity: Last-Mile Technology

While immediate delivery was previously a source of competitive advantage, it has become a need-to-have. Consequently, last-mile technology has become a vital component of the supply chain to lower costs and improve client satisfaction. Ohi uses micro-fulfillment centers in urban areas that are closer to customers to reduce delivery times and shipping costs. AxleHire’s end-to-end platform and network of drivers enables efficient and cost-effective same-day and next-day delivery. Deliverr (an Activant portfolio company acquired by Shopify) is a leading provider of 1 and 2-day delivery for e-commerce merchants, powered by its asset-light warehousing network and machine learning demand planning capabilities.

5Fintech Can Solve One of Logistics’ Biggest Frustrations

20% of all freight invoices have an error

Pain Point: Lack of Accessibility to Best-in-Class Financial Solutions

The freight and logistics industry has been poorly served by the financial services industry. Within the trucking world, cash and bank checks are still the norm. Many participants still operate on paper instead of electronic payment methods. The time spent manually processing expenses, invoices, payments, and auditing is significant and costly. On average, it takes 50 days to process and pay a single invoice within logistics. 20% of which have an error. All of these manual and lengthy payment processes ultimately hurt everyone in the ecosystem, including carriers, drivers, brokers, and merchants.

50 Days

Average time required to process a pay a single invoice in logistics

Opportunity: Digitization of Payments & Improved Payments Infrastructure

Innovative players are offering faster and more cost-effective alternatives to expensive and outdated legacy solutions. Loop’s platform uses natural language processing to audit invoices, streamlining resolutions and payments. Coast provides fuel cards and comprehensive expense management software to fleets of all shapes and sizes. Relay Payments connects brokers, drivers, and merchants on a mobile-first, digital payments network.

6Automation Addresses Increased Warehouse Challenges

More than 50% of warehouses today have no automation…only 5% are using sophisticated automation equipment & solutions

Pain Point: Warehouses are Under-Optimized

Traditional warehouse infrastructure has struggled to adapt to the challenges of e-commerce growth and customer expectations, SKU complexity, near-shoring, and labor shortages. Warehouse automation attempts to optimize warehouse performance, addressing inefficient use of space, inventory tracking, high labor costs, and poor customer experience. A study by Roland Berger suggests that robotic logistics and distribution can decrease handling costs by 20-40% and increase productivity by 25-70% by 2025.

20-70%

increase in productivity possible with robots

Opportunity: Warehouse Automation

With this in mind, we look to players like Dexterity, who offer full-capability robots that pick, pack, stack, palletize and fulfill without changing workflows. Kargo, an Activant portfolio company, has developed a smart loading dock sensor platform to verify and manage incoming and outgoing freight. This automation of shipping and receiving allows for more intuitive and responsive operations. SVT Robotics attempts to solve the problem of integrating robots from different vendors into one seamless orchestration platform.

7Digital Freight Services Fix Asset Underutilization

Each year, heavy trucks travel empty for 61 billion miles, emitting more than 87 million metric tons of carbon emissions

Pain Point: Asset Underutilization

Transportation capacity is often underutilized, particularly on a journey’s return leg, because matching them with outbound legs is a complex process. For example, in 2021, ~15% of truck trips in the US traveled empty, while the total marginal cost of trucking grew to the highest level on record. The situation in Europe is also challenging, with empty trucks at ~20% and road freight rates hovering around all-time highs. These empty miles and increased costs have financial and environmental impacts on shippers and carriers.

~15%

of truck trips in the U.S. are empty

20%

the percentage of empty trucks in Europe

Modern digital freight marketplaces and forwarders extract efficiency from complexity. They automate pricing and documentation, reduce empty miles by combining cargo, choose the best routes, and change these in response to real-time disruptions. Flock Freight’s platform uses algorithmic pooling technology to fill empty spaces in trucks, resulting in efficiency gains for both shippers and carriers. Leaf Logistics is offering a new approach to freight contracting, with guaranteed coverage and committed rates. Cargomatic’s extensive local freight marketplace connects shippers and carriers, covering all modes of transport and all routes from ports through to in-home delivery.

In Conclusion

We are energized by the pure pace of innovation in logistics. Things that might seem today like science fiction, such as…

- a completely hands-off and autonomous fulfillment process from purchase to doorstep…

- an accurate geospatial positioning sensor, thinner than an AirTag, on every box…

- and items manufactured next to the end buyer, not halfway across the world

…are much closer to reality than we think – due to the hard work of hundreds of fast-growing logistics companies solving big, complex problems for their customers with innovative products and business models. Most exciting of all, these technologies won’t just be available to a select few huge merchants, but every merchant that adopts them. We’re excited to continue to back founders and teams across the sector that are enabling everyone to become a logistics company.

Please get in touch if you’re building a company that’s transforming logistics - we'd love to talk.

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.