Topic

Supply Chain & Logistics

Published

July 2023

Reading time

19 minutes

The Future of Transportation Management Systems (TMS)

Why the next generation TMS won't be a TMS at all

The Future of Transportation Management Systems (TMS)

Download ReportResearch

Introduction

Since their introduction more than 50 years ago, Transportation Management System (TMS) software has grown to become a mission-critical component enabling the worldwide movement of goods. Your most recent grocery haul and new home exercise equipment, along with your business’ purchase of everything from office supplies to raw materials and inventory was made possible by a TMS. Over the years, TMSs have grown in size and scale, and have permeated all of the steps in the supply chain. Yet despite their ubiquity, we believe that today’s TMSs simply aren’t enough. They are old and legacy, don’t serve the mid-market or smaller customers efficiently, are missing key features, and often create more pain points and clumsy workarounds than the number of business problems they solve.

But we believe that is changing – largely because compelling new logistics tech companies are entering the market. In this article, we offer an overview and history of the category, as well as two frameworks to understand the product and distribution of TMSs and how to think about the emerging vendors. Throughout our research, we asked ourselves: does a next generation TMS even need to be a TMS at all? Some of today’s most compelling new vendors might offer their own TMS or TMS-like features but are agnostic as to whether you use them for that or not. Their real value-add is sitting on top of existing TMS systems and leveraging data created to offer compelling new insights and actions.

Setting the Stage

What is a TMS, and why should we even care what generation we’re on? A TMS is a software platform that tracks the physical movement of goods from point A to point B – everything from planning which carrier to use and at what rate, to tendering and executing the shipment, to tracking the load’s progress, to settlement and analysis after delivery.

A TMS is a mission-critical, system-of-record workflow software that drives revenues and manages expenses in a logistics industry that can be cyclical, competitive, and low-margin. Generally, all key parties involved in the supply chain – including shipper, carrier, freight forwarder, and broker – have their own version of a TMS to support their differentiated role in the movement of goods. The TMS is used daily by anyone in these organizations that help manage freight.

Ultimately the promise of a TMS – its stated value proposition – is to optimize a business’ transportation operations. Through centralized planning and data, and improved execution and tracking, an effective TMS can provide clear visibility and analysis of freight shipments. This leads to fewer disruptions and delays, better use of resources, and improved profitability.

It’s of little surprise that the TMS market is large and growing, with analysts projecting 15% to 19% annual growth through the rest of the decade to reach a market size of between $31B to $45B globally. TMS adoption is also high. According to recent industry surveys, 90% of carriers with more than 20 trucks and 68% of brokers use a TMS. Overall, 61% of logistics professionals, irrespective of firm size, use some form of TMS today, vs. 15% in 2005.

$45B

Projected TMS Market Size by 2030

TMSs have created an incredible amount of value to date. Today, the leading providers have valuations in the tens of billions on hundreds of millions or more of revenue. Blue Yonder had over $500M of annualized recurring revenue at the time of their sale to Panasonic, Descartes boasts nearly $500M of annualized services revenue from their most recent quarter, and WiseTech’s market cap stands at $17B. The top 5 vendors in this massive market control ~17% market share.

$500M

Blue Yonder ARR at time of Panasonic acquisition

History

But today’s TMSs are old. The leading TMS vendors were mostly founded in the 1970s and 80s, built on inflexible mainframes from suppliers like IBM. They started by digitizing manual processes and paper-based workflows. They offered basic features like planning, visibility, and execution, while centralizing shipment data. And they focused on serving the enterprise, particularly the enterprise shipper, who ultimately controlled the budget on shipping spend.

Legacy players fall into three groups:

- The original supply chain management software vendors who started in the 1970s, like E2Open and Descartes;

- Enterprise software vendors who have expanded into logistics, like SAP and Oracle;

- More “recent” TMS vendors like Mercury Gate, who launched their solution in 2000, over two decades ago.

Limitations and Pain Points

Over the years, the legacy TMS options have not kept up with the needs of their customers. Incumbent solutions are challenging to use, limited in features, expensive, and slow. Their UI/UX is dated and feels ‘Web 1.0’. Implementation times and ramp-up periods are long and cumbersome.

As the supply chain grows ever more complex, customers have asked for greater functionality – such as procuring freight capacity, offering real-time visibility, extending into the warehouse, and handling multiple transportation modalities. However, TMS vendors have been unable to follow through, and meaningful gaps have emerged in their solutions. According to a recent survey, only 60% of current TMS providers offer procurement & sourcing, only 50% offer warehouse management capabilities, and visibility solutions remain surprisingly simplistic, a lot of ‘dots on a map’, as do post-shipment reporting and analytics.

In addition, the incumbents have not served the mid-market or smaller customers well. They have yet to fully adapt their offerings for the cloud in order to lower the upfront investment to smaller customers. High fees, long deployments, slow product development, and poor customer support have inhibited adoption.

Like many other software categories dominated by incumbents, the legacy players have been more focused on M&A to acquire products and customers rather than investing in R&D. This trend has been accelerating. From the end of Q1 2021 to the end of Q2 2022, there were 115 acquisitions as the leading vendors continue to roll up the industry. In the first half of 2023, CargoWise (part of WiseTech) spent nearly 6x more on M&A than on R&D (i.e., AU$ 115M on R&D vs AU$ 644M on M&A).

115

Acquisitions by leading TMS vendors from Q1'21 to Q2'22

It’s no surprise, then, that nobody likes their existing legacy TMS platform. We’ve heard complaints in nearly all of our conversations with supply chain companies and users. Everyone is on the spectrum between growing dissatisfaction to outright dislike. But remember the system-of-record nature of TMSs. Despite their issues, legacy TMS vendors have continued to dominate and claim the lion’s share of the market, simply because “nobody gets fired for buying IBM.”

The Rise of the Next Generation

But there is good news.

We see an incredible opportunity in the market to build a better TMS to address customer pain points and better serve unhappy customers, large and small. The stars have aligned for next-generation TMS vendors to gain real traction, challenge the incumbents, and build foundational businesses.

Beyond the shortcomings of the existing solutions, several more factors have helped create this opportunity:

- Over the last few years, we’ve seen increasing complexity and vulnerability in the supply chain, made evident by the disruptions caused by COVID, geo-political conflicts, and big headline-grabbing events like the blockages in the Suez Canal.

- In the face of this uncertainty, we are seeing the end customer demand more from their vendors, including tighter SLAs, lower costs, and much more granular tracking.

- As the logistics tech industry continues to grow and attract investment, legacy TMSs can offer advanced features through partnerships with leading VC-backed logistics tech startups offering more modular, bolt-on solutions, such as real-time visibility.

- Finally, the growth and maturity of enterprise technology infrastructure like cloud and SaaS have lowered upfront technology barriers for new entrants into the category and for smaller customers to adopt TMS solutions.

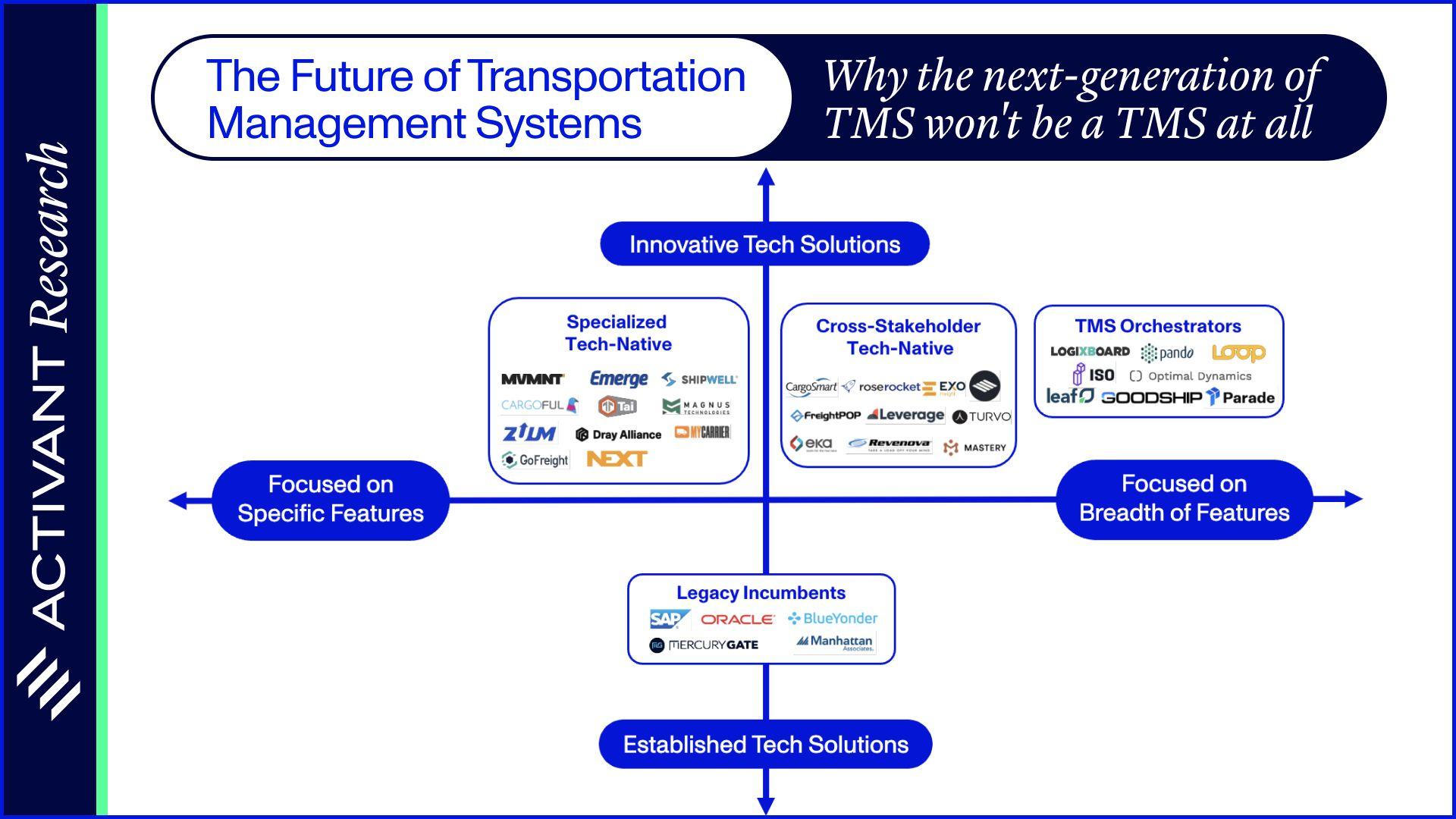

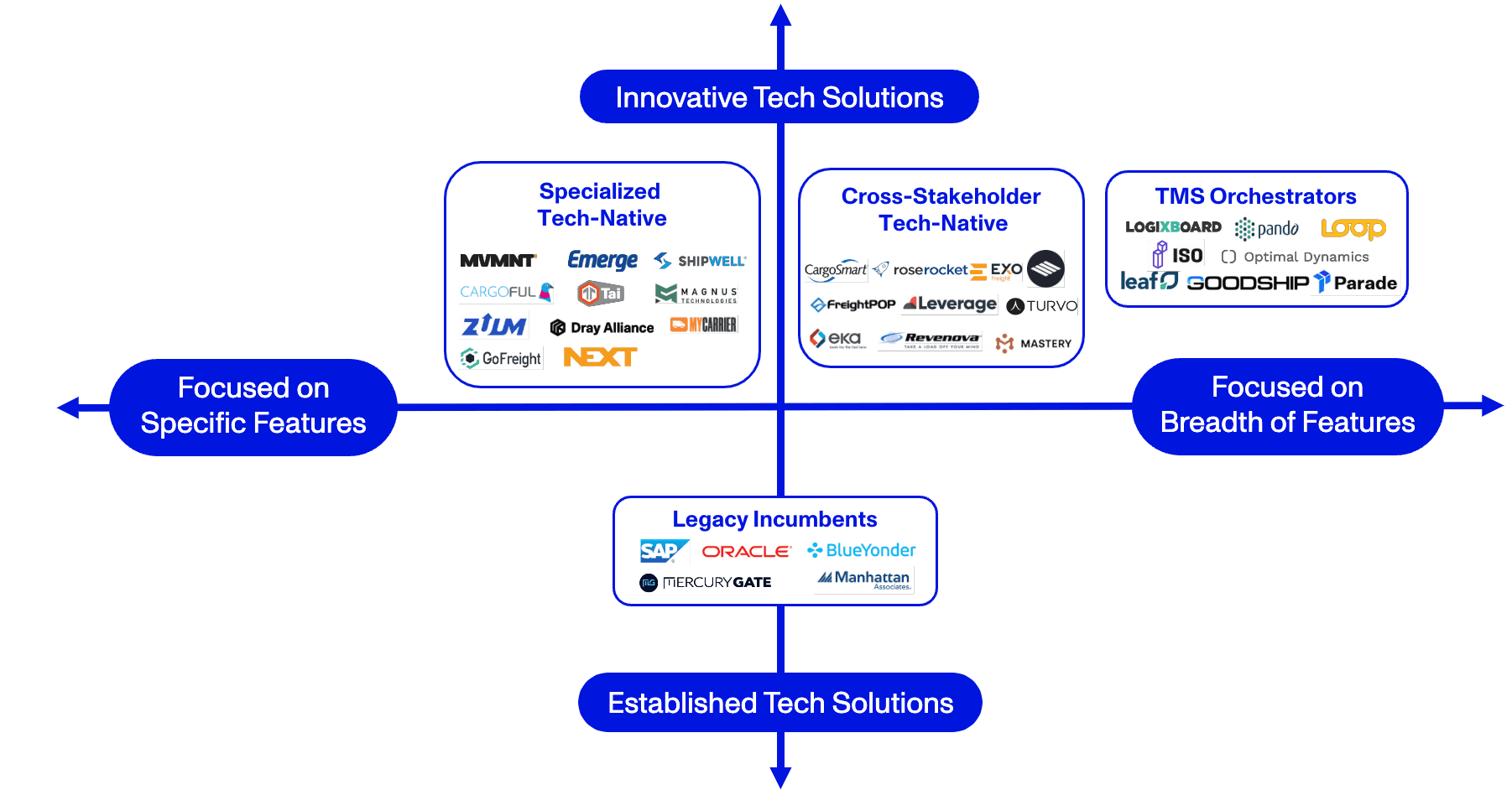

Activant TMS Market Map

So, who are the emerging TMS vendors looking to take advantage of this opportunity? Introducing the Activant TMS Market Map:

Market Map

Transportation Management Software

Note that this market map is a work-in-progress. Our understanding of the market is rapidly evolving - if you have a differing view, or want to share your perspective, please reach out!

We have spent a lot of time in this category and have talked to many leading TMS vendors and their customers. Before jumping in, it’s worth stepping back and noting that there are 1500+ TMS vendors globally. To simplify this market, we have segmented the world based on key criteria, including target market and geography, tech offering, number of features, and model complexity. This resulted in 4 broad non-mutually exclusive categories: Legacy Incumbents; Specialized Tech-Natives; Cross-Stakeholder Tech-Natives; and TMS Orchestrators.

- We think of the Legacy Incumbents as both the initial providers of TMS solutions and multinational enterprise software players. Their solutions are often part of a larger tech suite and face many of the challenges we’ve discussed above.

- The Tech-Natives generally have more streamlined and flexible interfaces, which makes for a better user experience. Amongst these, the Specialized providers typically focus on a specific stakeholder in the supply chain, at least to start, offering a differentiated and richer solution to that segment. By contrast, the Cross-Stakeholder platforms focus on connecting multiple stakeholders across the supply chain.

- The Orchestrators usually integrate into and improve existing TMS solutions, whether through simplifying cross-platform communication, plugging feature gaps, or scaling across adjacent segments of the supply chain.

Back to the Basics: Product and Distribution

Now armed with our Market Map, we want to double click on the interesting categories and companies to help emerging TMS vendors think about how to tactically approach the market and grow their business. We believe every TMS vendor should be thinking about two major considerations: (1) product features, and (2) distribution approaches. We highlight these approaches to building product, tied together by our TMS Features Pyramid framework below, and discuss three approaches to distribution.

The Activant Product Pyramid

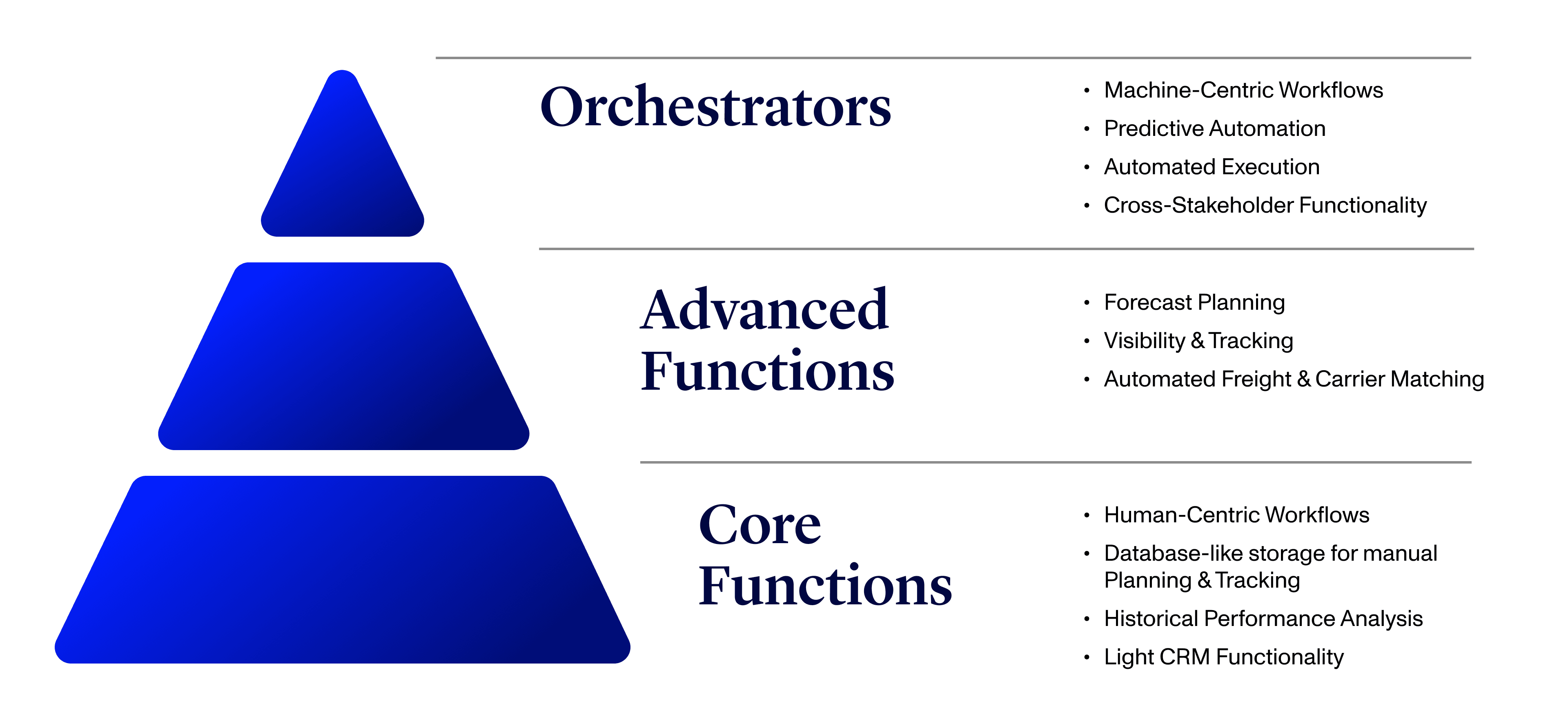

Our Product Pyramid framework presents how to think about the various products and features that a TMS can offer:

Framework

TMS Product Pyramid

At the bottom of the pyramid, Core features include optimizing loads, identifying and selecting the best carriers and routes, shipment tracking through connectivity and communication, settlement, and reporting, and analysis. These are the basic tools to get shipments from A to B.

In the middle layer, Advanced features deliver improved forecasting, planning, management, and automation for users. They address the demand for increased resilience, globalization, and sustainability.

Finally, at the top of the pyramid, Orchestrator features include making better use of large data sets, usually with artificial intelligence and machine learning, as well as deeper integrations with other systems to enable automated changes, transactions, and execution to reduce humans-in-the-loop. These features are still less common, though many vendors are actively building and refining them.

The Orchestrators

Supply chain software vendors focused on the top of the pyramid are looking to be the intelligence or orchestration layer. They usually don’t offer a TMS, and instead look to integrate with a customers’ existing TMS vendors to generate insights that the TMSs themselves don’t have and can’t offer. In doing so, they provide the final layer of features required to elevate a TMS to the next generation, but they do so without providing a TMS themselves – hence the next-gen TMS may not be a TMS. This segment is tied to the "Orchestrators" segment in our Activant TMS Market Map.

The primary benefit of this approach is to simplify a customer’s fragmented supply chain tech stack, allowing for a ‘single pane of glass’ to monitor and control everything. There isn’t a need to replace entrenched incumbents, minimizing cost and disruption, as well as shortening sales cycles. However, these solutions are not typically the system of record – relegating that task to the legacy TMS – and this could reduce the overall stickiness of the platform.

- Logixboard enables previously analog freight forwarders and carriers to become competitive digital freight players. They provide a white label solution for their customers, while taking care of all the back-end integrations and functionality. A big plus and driver of adoption is the ease with which they can integrate the TMSs of their customer's shippers.

- Pando has developed their TMS product over the past five years, to what is now their Fulfilment Cloud. This delivers an AI-powered no-code platform with end-to-end collaboration from shipper to customer. In addition to providing many of the solutions expected of a next-gen TMS, their products attempt to unlock customer benefits like new GTM channels, circular economy and ESG solutions, digitization, manufacturing innovation, supply chain integrations for M&A, etc.

- Optimal Dynamics is a leading innovator in automated decision-making for freight management. They integrate into existing TMS systems and build digital twins of a supply chain network, thus aiding decision-making by predicting loads to increase the probability of being profitable. Our discussions with clients and experts suggest their solution is highly accurate and offers significant depth and breadth of information.

- Leaf Logistics is the ‘air traffic control’ that sits agnostically on top of multiple TMSs. Their two main products are Flex and Adapt. Flex helps shippers identify future transport needs and locks in carriers at fixed rates to ensure consistent demand and lower costs. Adapt is a shipper software monitoring timeliness, savings, and sustainability. The company also plans to launch Pay to help pay LSPs in 30 vs 120 days.

- ISO.io is a performance management solution. By mapping internal & customer SLAs and aggregating data from a company’s TMS, ERP, and other core systems. ISO.io benchmarks and identifies discrepancies to generate carrier scorecards. ISO then allows carriers to refute a claim, which often translates to real dollars in carrier’s pockets. Additionally, this data is available to the whole organization, breaking down silos between transport, sales, finance, and customer service.

As technology enables better visibility in this industry, focusing on multiple stakeholders and systems to orchestrate the flow of data is key."

Julian Alvarez, Founder & CEO, Logixboard

The Vertical Approach

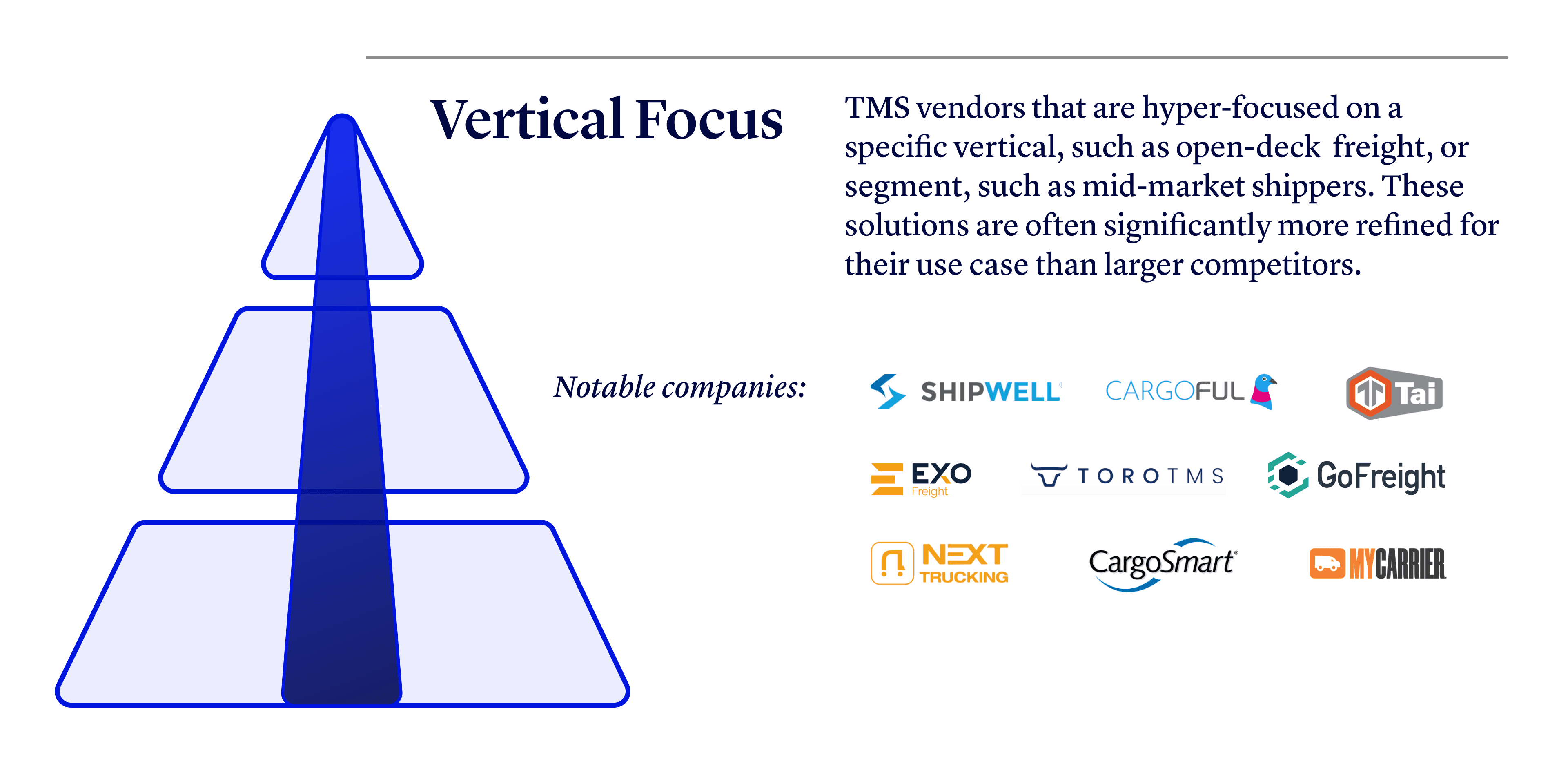

Companies with a vertical focus are building solutions for a specific segment (e.g. customer type, part of the value chain, modality, or business model). Nonetheless, they can evolve to serve more segments over time. This segment ties most closely to the "Specialized Tech-Natives" segment in our Activant TMS Market Map.

Specific problems are more easily addressed by specialized solutions, allowing for a quicker and cheaper GTM strategy, as well as easier upsell opportunities. They are more effective at solving market-specific needs, which makes them valuable for companies growing beyond ‘off the shelf’ standard solutions. The biggest drawbacks could be a smaller addressable market, limited diversification potential, and subsequent niche concentration risk. Companies to highlight:

- MyCarrier started out as offering a TMS to SMBs who needed to ship LTL (less than truckload). By partnering with many LTL carriers, they serve shippers, who can more easily connect and automate shipment execution. They are now expanding into ERP order integration and freight audit.

- Exo Freight focuses on the open-deck shipping segment. Their own, or clients internal, shipper-focused TMSs combine with a carrier management portal to provide an extensive marketplace and network.

- GoFreight enables international freight forwarders to easily digitize via one platform. While not a typical TMS, they offer an all-in-one SaaS suite of essential freight forwarder services, via their own and partner apps and APIs.

- Shipwell offers shippers a fully managed solution (TMS, advanced visibility & an easily integrated network) to mid-market and lower enterprise clients. They also lever off their large integrated carrier network.

- Cargoful is a next-generation TMS enabling E2E (end-to-end) order management for carriers. A differentiator is their use of machine learning and operations-research tech to support long haul, last mile, and urban delivery.

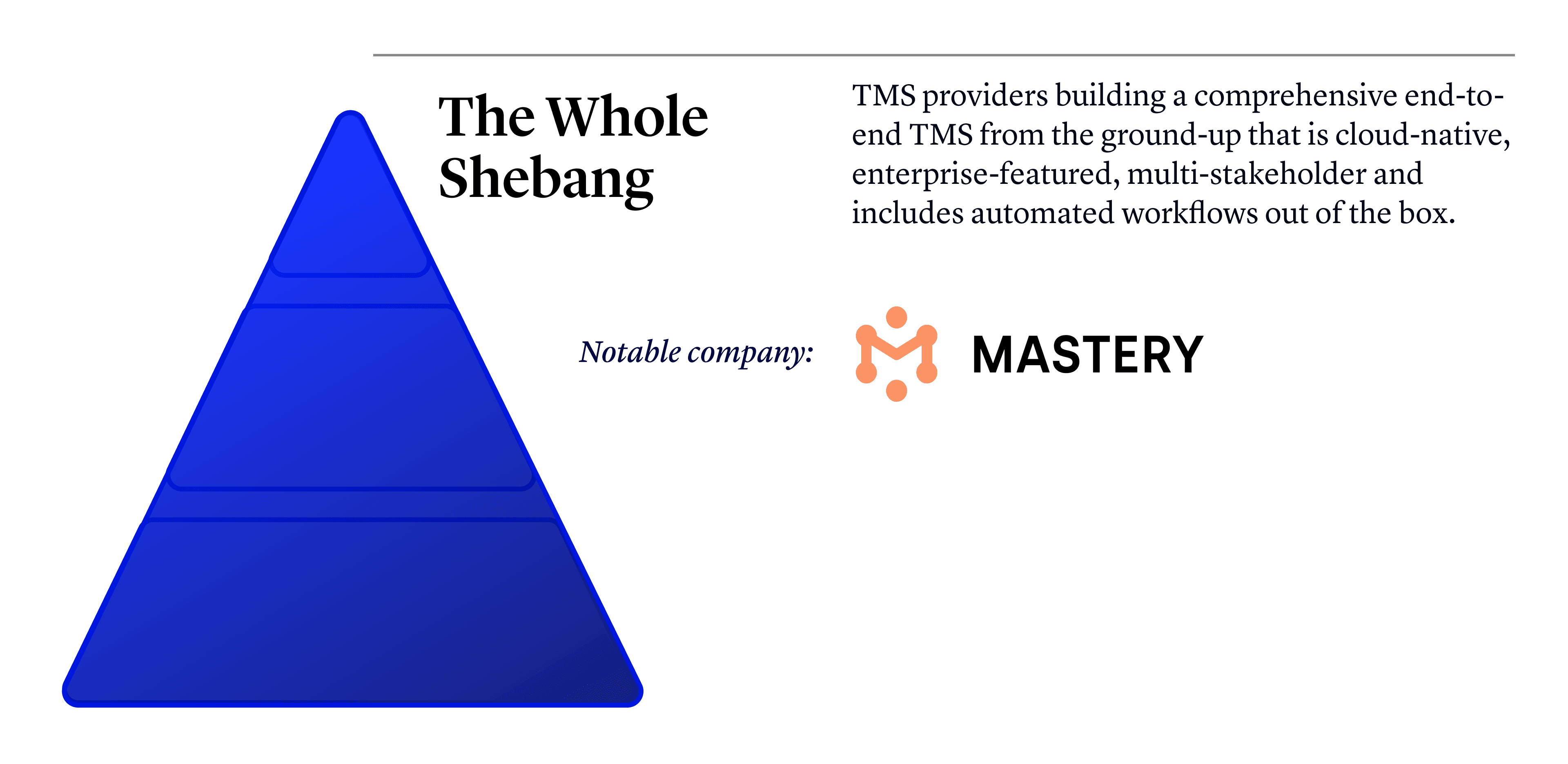

The Whole Shebang

“The Whole Shebang” approach is exactly what it sounds like – the construction of an entire TMS from the ground up. Naturally, building from the ground up requires significantly more time and invested capital than either of the other to Product approaches, but in replacing the incumbent TMS, these players will enjoy a hire stickiness than pure Orchestrators. However, success also requires (1) clear product market fit, (2) the flexibility to tailor the product to multiple stakeholders and (3) the ability to overcome the stickiness of the incumbents.

To our knowledge, the only player currently exploring this route is Mastery Logistics Systems. They are building an enterprise-level platform which attempts to roll up all customers’ (initially carriers & brokers) existing TMSs and functionality, irrespective of mode.

Building a TMS from scratch is really ******* hard, which is why it’s worth doing! Nobody has been able to build a TMS in decades that provides the whole solution for the enterprise – we are uniquely capable of delivering what the industry badly needs."

Jeff Silver, Co-Founder & CEO, Mastery

Distribution

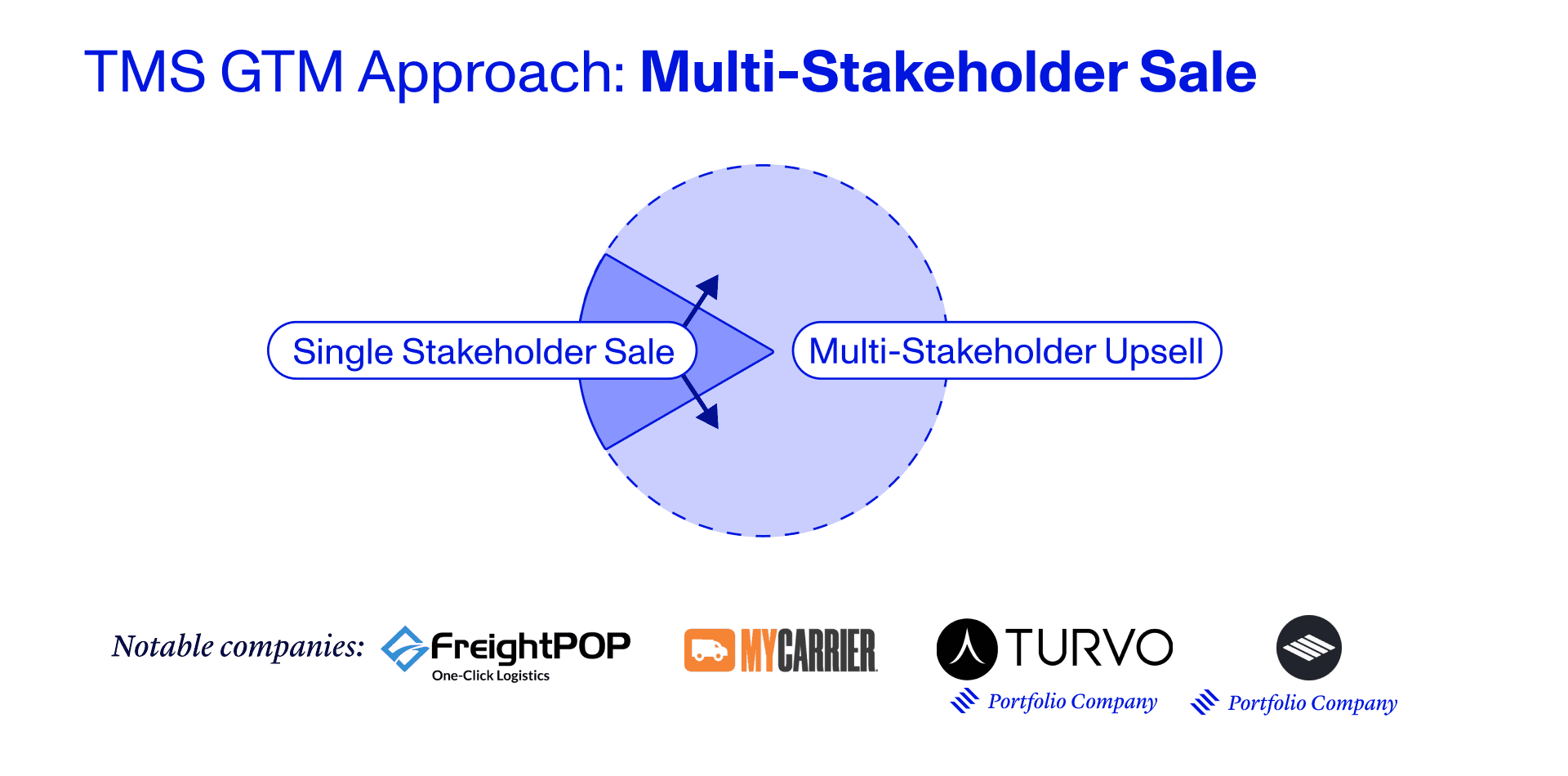

While Product remains an axis we use to index companies, we have found Distribution strategy to be an equally compelling tool for segmentation. Here, we highlight three notable approaches to distribution that we have consistently seen from current TMS vendors. Our Distribution graphic below captures these strategies and illustrates how the core offering starts near the center but then grows outwards into untapped markets.

Multiple Stakeholders

These vendors aim to provide solutions for different stakeholders (e.g. shippers, carriers, brokers, forwarders, 3PLs, NVOCCs). They often start with one key relationship, which in turn generates a client-driven cross-sell. The strength of these products is in their cross-sell potential, which in turn can lead to network effects between stakeholders. However, in building for multiple parties, this approach risks creating misaligned incentives in product-market fit – where multiple parties have different product requirements. This segment ties most closely to the "Cross-Stakeholder Tech-Natives" segment in our Activant TMS Market Map.

- FreightPop provides a TMS with a comprehensive feature set that addresses a wide range of stakeholders (from manufacturers to 3PLs). Notably, they provide rate shopping, freight visibility, freight planning, and freight audit.

- Rose Rocket offers a TMS with a menu of integrations that allow their clients to quickly automate and connect data internally and, importantly, across their network of customers, drivers, and partners.

- Turvo, an Activant portfolio company that is now part of Lineage Logistics, was one of the early next-gen TMS companies. It was built on the premise of collaboration by breaking down the walls between different stakeholders, systems, and processes.

- Pallet, an Activant Portfolio company, offers an integrated platform that combines a Transportation Management System (TMS), a Warehouse Management System (WMS) and a Billing System. Over time, the company also plans to build and integrate an Order Management System (OMS). This unified SaaS platform becomes the “Operating System” for 3PLs that eliminates the need for customers to reinput data across multiple siloed platforms that individually accomplish a segment of the solution.

Alternative Monetization

These vendors use their TMS as a wedge into a customer and monetize indirectly (but not with TMS fees). So, the TMS might be almost free and then revenues are generated via alternate embedded products or monetizing different stakeholders. Obviously, it is hard to beat free, which also shortens sales cycles. Additionally, new technology makes it easier to embed solutions, and there is greater potential to align incentives with customers. A drawback could be a perception of a less valuable product, with customers wondering "what's the catch?"MVMNT offers their TMS for a minimal cost and monetize via financial services tools like factoring, and insurance which allows SMB brokers to become more attractive & competitive.

- MVMNT offers their TMS for a minimal cost and monetize via financial services tools like factoring, and insurance which allows SMB brokers to become more attractive & competitive.

- Emerge uses their (essentially free) TMS to provide dynamic RFPs to shippers. This in turn attracts carriers to their marketplace – from which they monetize based on transactions.

- Zuum provides a free TMS which integrates to their digital freight marketplace. In doing so, they enable all stakeholders to effectively become digital brokers and capture capacity, carriers and data.

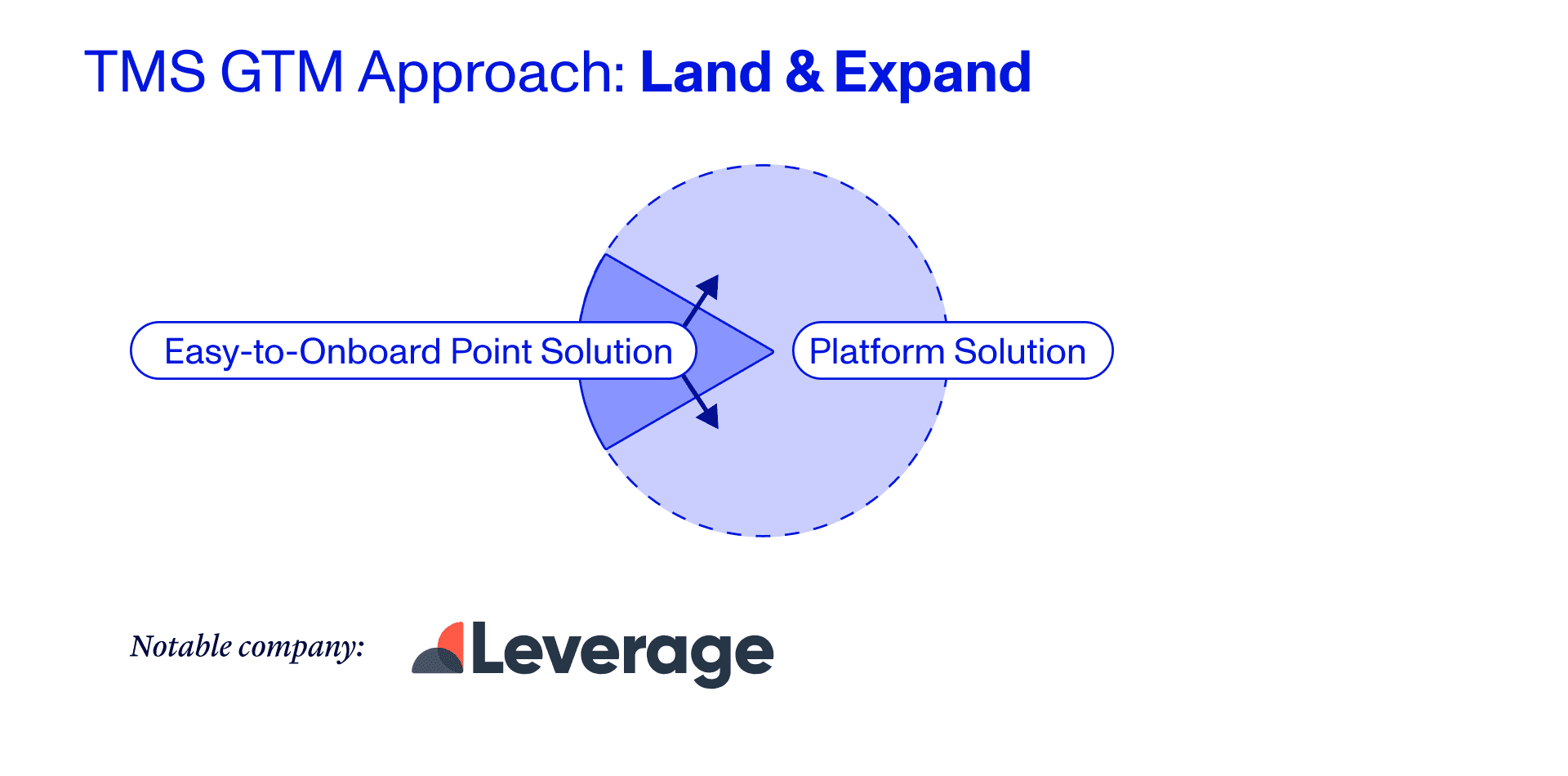

Land & Expand

Somewhat like Orchestrators, these vendors have created solutions that aren’t typical TMSs, but enhance their functionality. The strength of these products is in their speed to market and shortened sales cycle. Furthermore, they offer classic ‘land and expand’ opportunities (both within a customer and across the value chain). However, they carry the risk of being perceived as a point solution initially.

Leverage.ai promises one platform that easily integrates into existing systems, providing end-to-end visibility across the entire supply chain lifecycle. We like the customization, flexibility, and scalability – all of which we think are necessary for a next-gen TMS solution.

Conclusion

We’re excited about the next five years – the next 50 years even – for TMS. There will always be physical goods to move, and there will always need to be systems to enable that. We’re eager to see what those new systems will look like, and what the leading next-generation TMS vendors are already building today. And if we’re right, many of those next-gen TMS’s won’t need to be a TMS at all!

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.