Topic

B2B Commerce

Published

November 2022

Reading time

9 minutes

Check this Out - Part 1

There’s never been a truly digital checkout experience in B2B commerce, but that’s changing

Authors

Check this Out - Part 1

Download ReportResearch

Have you been sent an invoice and not known how to pay it or who to send it to?

Have you spent months running an RFP and at the end of it, still feel like you’re getting a bad deal?

Do you have email threads with vendors with replies numbering in the hundreds?

Have you sweat bullets when you enter wire details on your bank’s website before you send five, six, or seven figures worth of cash into what feels the ether?

Have you felt like that as, a customer, for some reason, you do all the work?

If you answered yes to one or more of any of these questions, chances are, you’re a B2B buyer. The symptoms are common, and the diagnosis is grim. Transacting from business to business is a messy affair. Manual workflows, data stored in many different places, and a lack of transparency pervade.

Truth is, the experience is no better for the vendor. They deal with much of what the buyer does, but across their entire sales pipeline and existing customer base, which could mean hundreds or thousands of active relationships. Thankfully, there’s a fast-emerging new category of platforms that all seek to ease the pain – B2B checkout.

B2B checkout is one of the most innovative and high growth sectors in B2B commerce. Catch up on our overview report of the market if you haven't already.

Double-Clicking on One-Click

This story echoes one that began a few years ago, when the “one-click checkout” market was emerging on the consumer side. When we led Bolt’s Series B in 2018, this wasn’t a category at all. Merchants selling online had their eCommerce platform (think Shopify or Magento), their payment processor (like Adyen, Braintree, or Stripe), and likely a fraud platform (like Forter, Signifyd, or Riskified). Why would they need yet another platform?

For smaller merchants, all three might be bundled together (say, if you were on Squarespace), or they might use PayPal. But mid-market and large sellers (too large for Shopify) had engineers piecing the tech stack together. In either case, shoppers checking out were presented with a different matrix of forms to fill out across every merchant and had to re-enter data when they came back to buy from the same site. While this inconvenience seems small, every ounce of friction matters – and matters most at the checkout, after customers have made it all the way to the point of purchase.

A platform that unified the checkout flow, payments, and fraud, while obscuring that complexity for the customer had the potential to lift conversion and help merchants. That’s the platform Bolt built and is still building today:

When Bolt started, checkout wasn’t a recognized category, but it was as obvious then as it is now that friction is real. So often retailers miss the opportunity to reclaim relationships with their customers and tap into the power of a network. Fast forward to today: checkout is most certainly a category.

Maju Kuruvilla CEO, Bolt

From B2C to B2B

We see strong parallels between what was beginning in consumer checkout 3-4 years ago and what is happening on the B2B side today. A workflow centered around a transaction. Incumbent processes that both buyers and sellers struggle with. Friction that hurts conversion and customer experience.

In order to solve it, you need a “cocktail” of many different components – payments, embedded lending, data infrastructure, and more.

Why not just use a credit card, you might ask? Business-to-business card acceptance is growing: it’s about 4% of the U.S. B2B payment volume, growing 5-10% per year. But when it comes to high transaction amounts (anything over $5 - 10k), traditionally neither vendors nor buyers want to bear the ~3% interchange fees required by with credit cards. Large purchases also require a series of stakeholders throughout an organization to sign off on a purchase, which can’t happen with a corporate card.

At the same time, credit is critical to B2B transactions. Net terms are the incumbent model for a reason – they smooth out cash flow for buyers and incentivize conversion. Accommodating lending and credit is a fundamental requirement of any B2B checkout player.

So is being in the flow of funds. Our definition of a checkout platform requires that a platform take on the flow of funds, which involves accepting, processing, and reconciling payment (either directly or through a partner). This reduces the burden on a vendor’s finance team, and critically gives the checkout platform visibility into their customers’ financial data they would not otherwise have. Data that can unlock compelling value-add for that customer, like better credit terms.

Finally, the entire category has only recently become possible. As we said in our , the figurative API sandbox is now full of toys. There’s a rich ecosystem of API-first platforms that supply critical data to today’s emerging checkout players to enable instant, digital data pulls. Critical components include detailed credit reports, KYB (know your business) data, and AML (anti-money laundering) data.

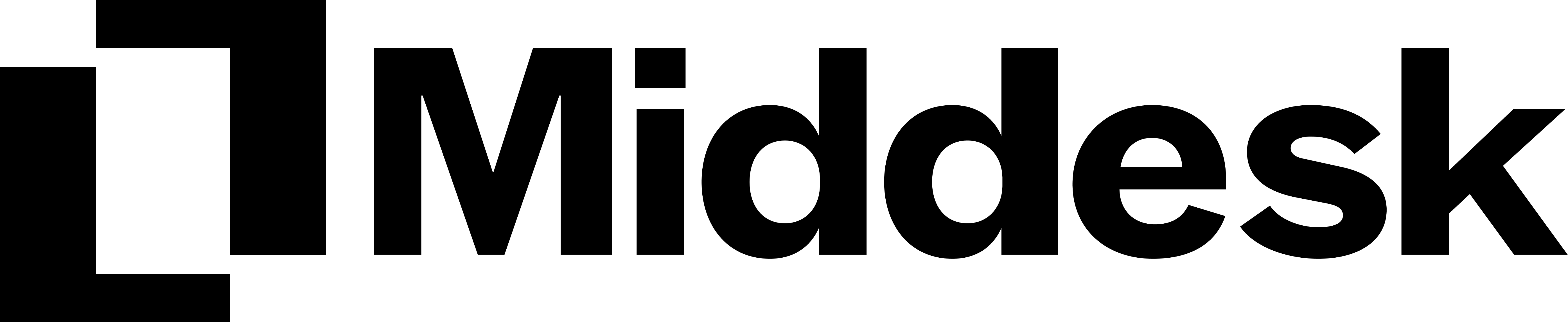

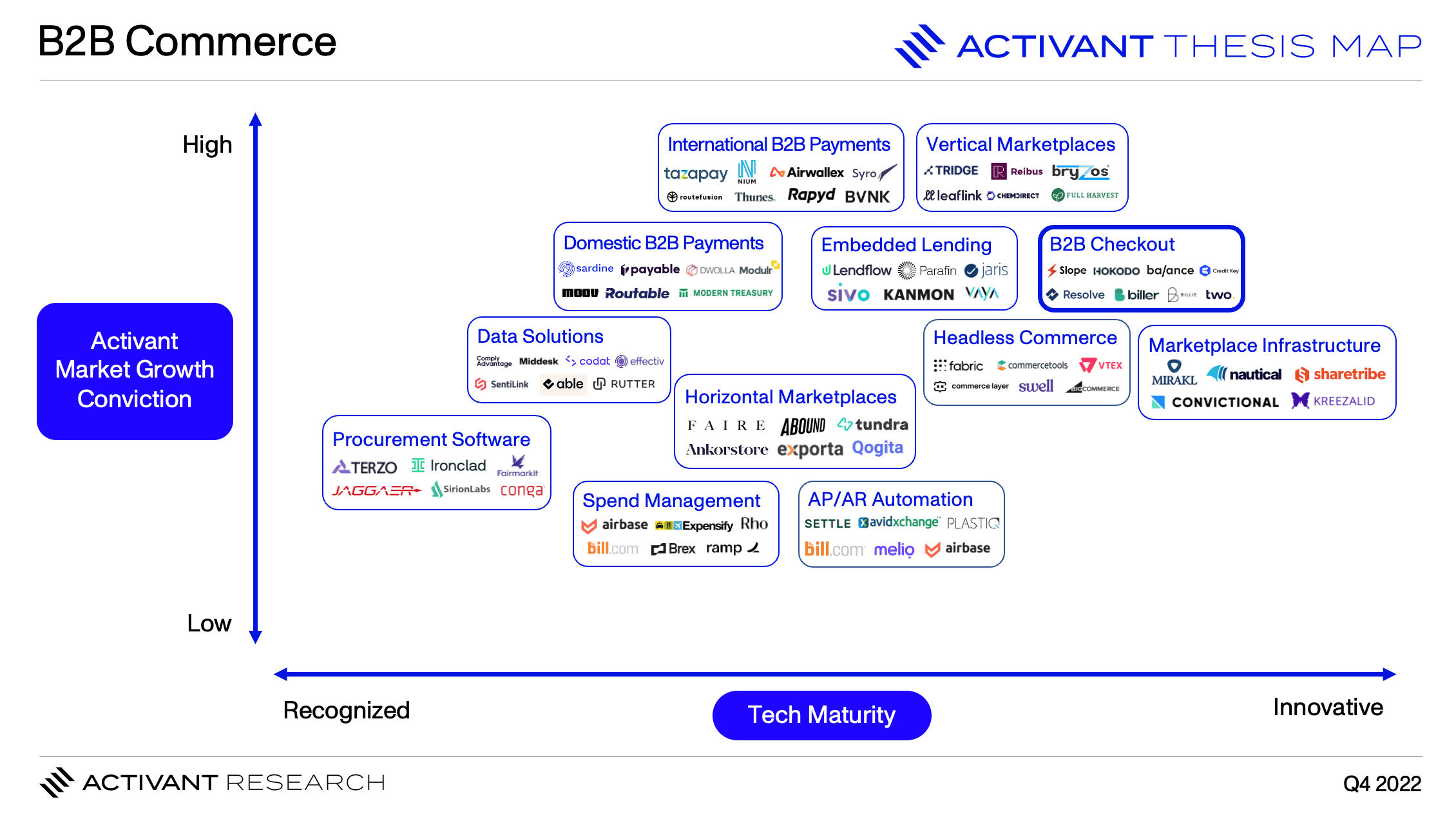

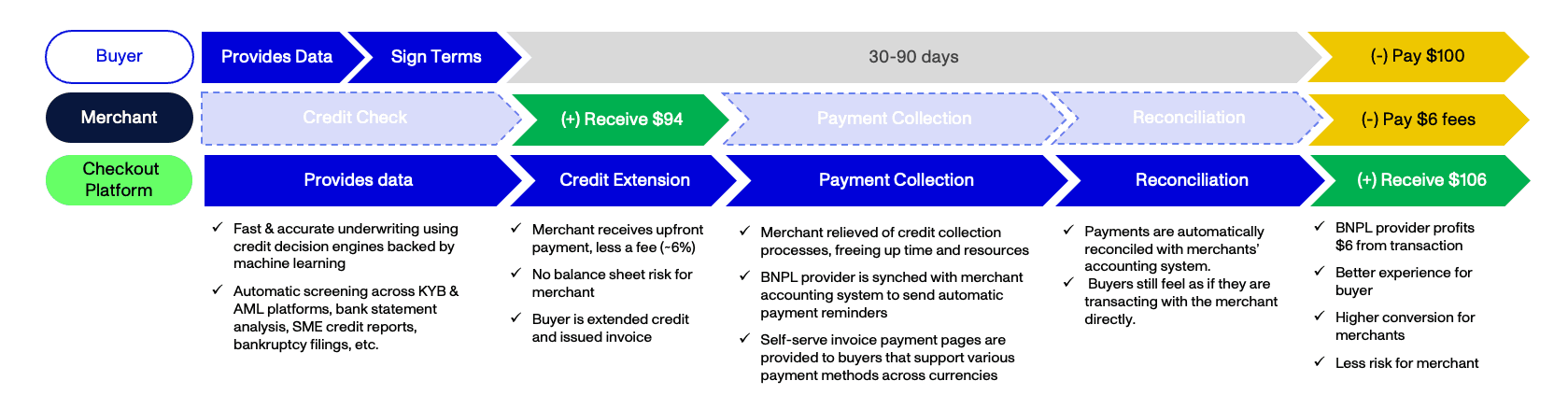

Visualizing the Value Chain

Without Checkout

Value Chain

Without Checkout

In the incumbent process, vendors must invest in teams of people to process credit-based transactions; these teams underwrite, extend credit, manage collections, and reconcile payment.

That means that a vendor must effectively become a financial institution. Huge, Fortune 500 companies have internal credit departments, staffed by armies of people processing paperwork. For example, John Deere employs over 1,000 people with “credit” in their job description to process forms like this. But unless you’re at scale, you can’t afford to offer this kind of product. And if you are the size of John Deere, we believe that technology can offer a better experience for both the merchant and the customer.

1,000+

people employed by John Deere with "credit" in their job description

With Checkout

Value Chain

With Checkout

When a merchant partners with a B2B checkout platform, they are relieved of the manual work and financial risk associated with lending. Sellers of any size get the same (or better) experience of a 1,000-person credit processing team for a 3-6% fee.

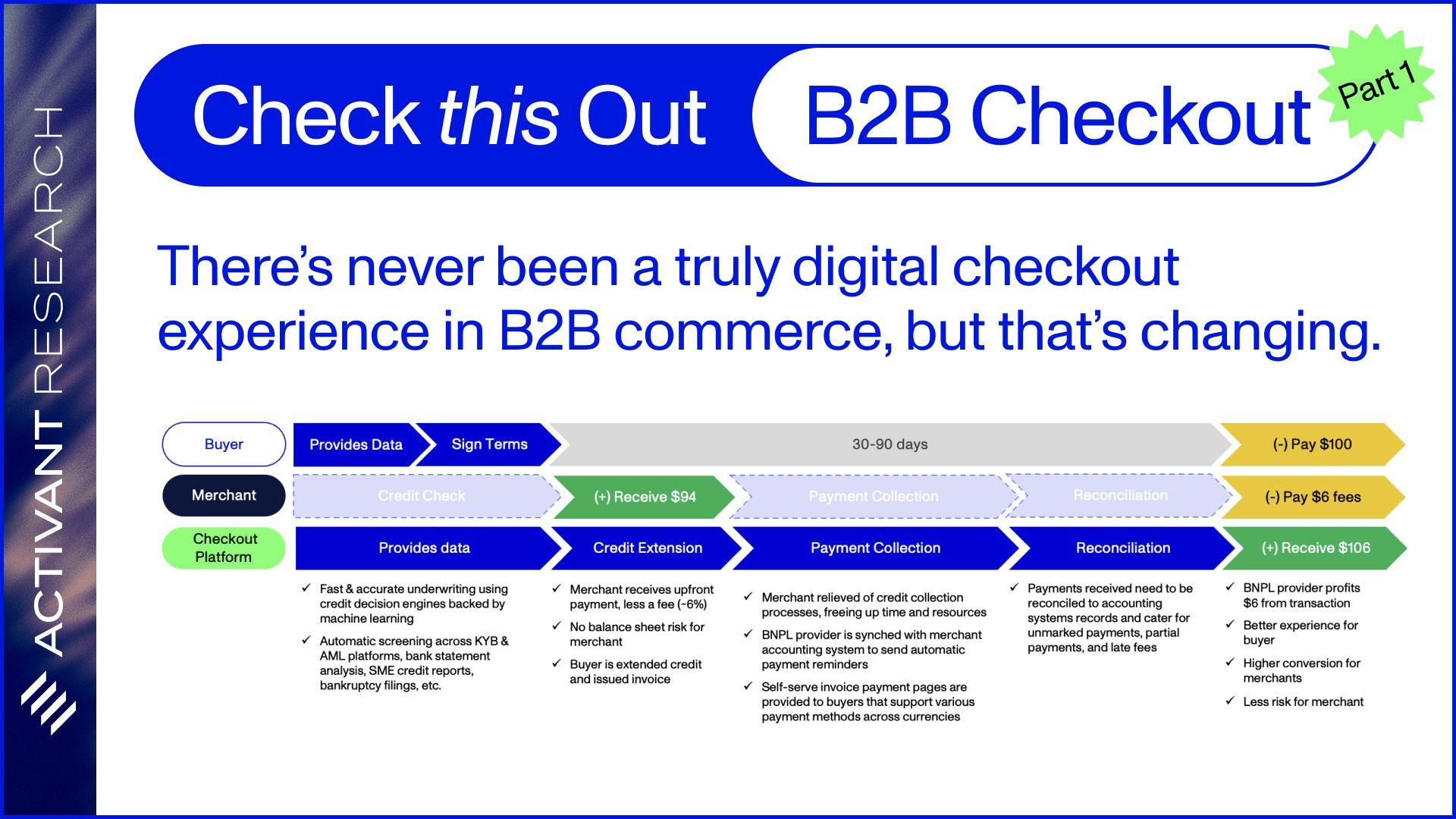

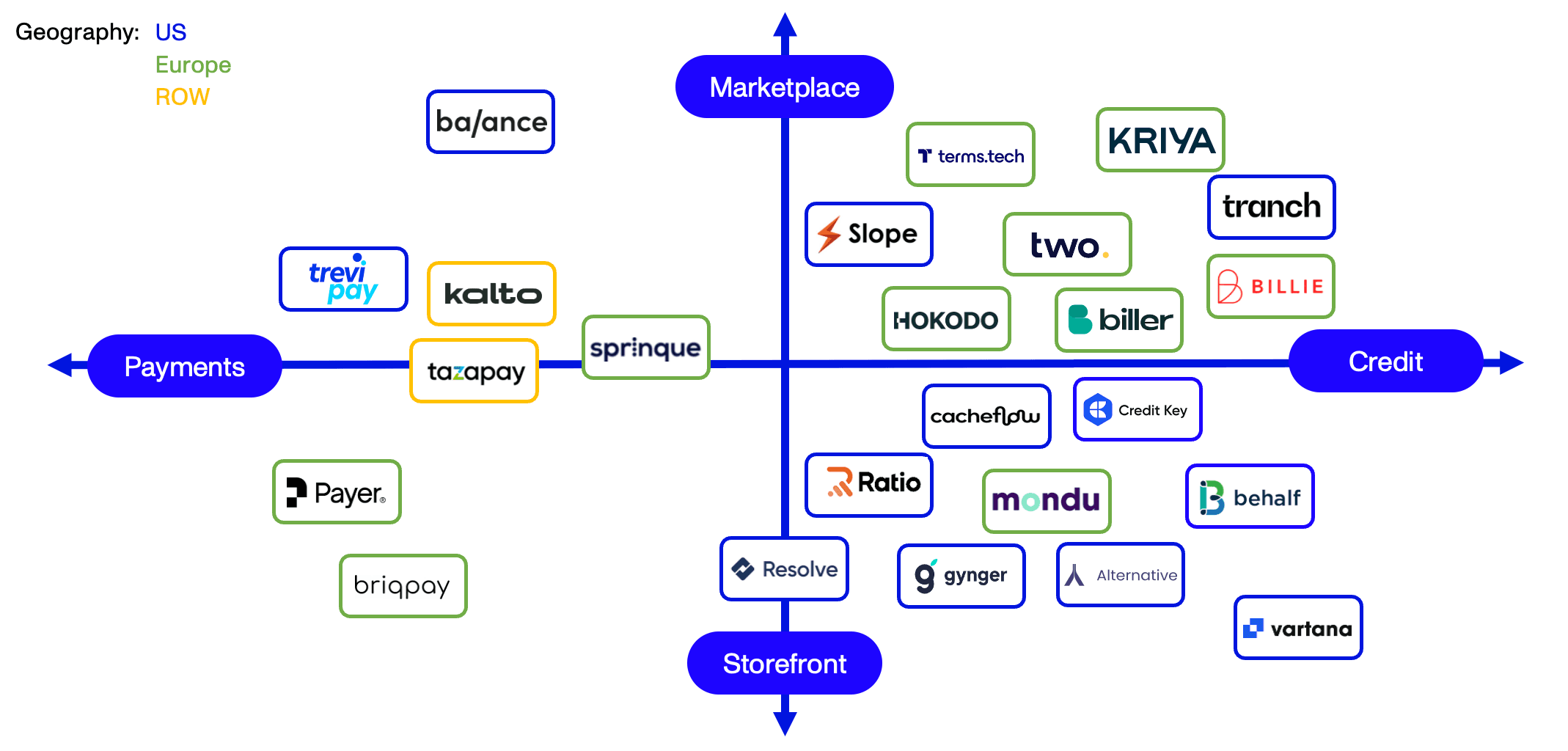

Market Map

The newest generation of players in this fast-emerging market are taking different approaches to solving checkout: we break them down across two axes in our Market Map:

Market Map

B2B Checkout

If you disagree with our perspective, we want to hear from you.

The X axis focuses on the solution: from Payment <> Credit;

- Payment here refers to companies that enable sellers to accept as many payment options as possible from their customers. Rails like ACH, wire, and card, treasury and escrow capabilities, and the ability to seamlessly send money cross border and across currencies. Think about coming to the point of payment on a merchant’s site and being presented with every possible option, all from one provider.

- Credit refers to players that use lending as their primary value proposition, and a wedge to build out additional functionality. Think about this like B2B BNPL. Rather than a larger revolving line of credit, they focus on financing an individual purchase. This involves lending capital to the buyer, eliminating balance sheet risk for the merchant, while increasing conversion and smoothing out cash flow.

The Y axis focuses on distribution: from Marketplace <> Storefront;

- Marketplace refers to checkout players that partner with B2B marketplaces to bring a trusted, fast, and seamless checkout to many counterparties.

- Storefront refers to those that partner with individual sellers to power checkout on their own ecommerce storefronts.

In Part 2 of this report, we'll walk through how these 18 players are tackling the market, including their go-to-market strategy, business and partnership models, and geographical focus. Stay tuned!

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.