Topic

B2B Commerce

Published

August 2023

Reading time

13 minutes

The Next Chapter of Embedded Finance

A Guide for How and Where to Play - to Win

Authors

The Next Chapter of Embedded Finance

Download ArticleResearch

Under the Surface: the Embedded Finance Opportunity

For as long as we’ve had banks, they’ve been fundamentally separate from business. Banks are singular institutions, operating in their own buildings — away from where we run our companies. Finance is available, but you need to actively seek out and engage with it.

This separation makes sense. You can’t have (and arguably wouldn’t want) a physical bank in every office. Of course, this isn't without its headaches. Business may be 24/7, but when the bank closes, everyone waits. At best, commerce is delayed; at worst, transactions are put off entirely.

As work has increasingly moved from physical spaces and into software, however, many are rethinking this separation. A handful of early movers, such as Shopify and Square, took the first steps, building the functionality of banks into their platforms — transforming the market and laying the groundwork for millions in VC investment. Now, a growing constellation of companies are embedding finance into the very core of our organizations.

The business case is compelling. The core is where finance is the easiest; after all, it’s where everything is already happening. It’s also where finance knows the most. Unlike a bank, which must learn your business on the spot, Shopify knows every transaction your business has ever made. Who do you think can better or more rapidly underwrite you?

The challenge, of course, is how quickly we can evaluate risk, drawing on internal data as well as that held by third parties. Banks are slow for a reason; this analysis takes time. Traditionally, bank personnel would weigh some combination of incomplete data and (perhaps) a personal relationship for days or weeks before making a lending decision. Now, software can pull on a variety of sources instantly, greatly clarifying risk and making finance a boost rather than a bottleneck.

To be fair, this kind of analysis is nothing new. The credit bureaus have been doing it for decades. The sea change, however, is the incredible rise of the embedded finance ecosystem, which finally makes possible the ability to leverage these data programmatically - and in real-time.

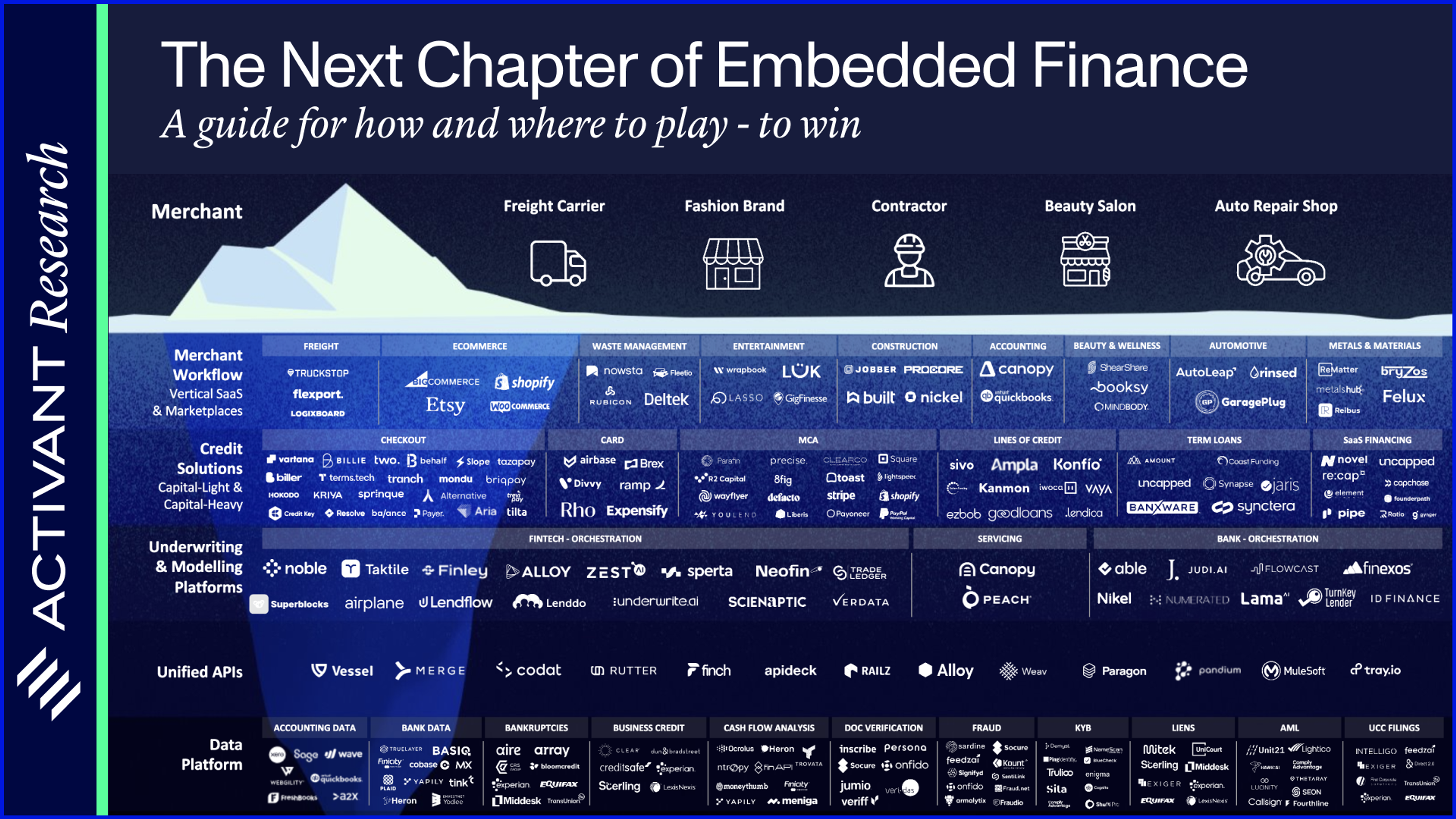

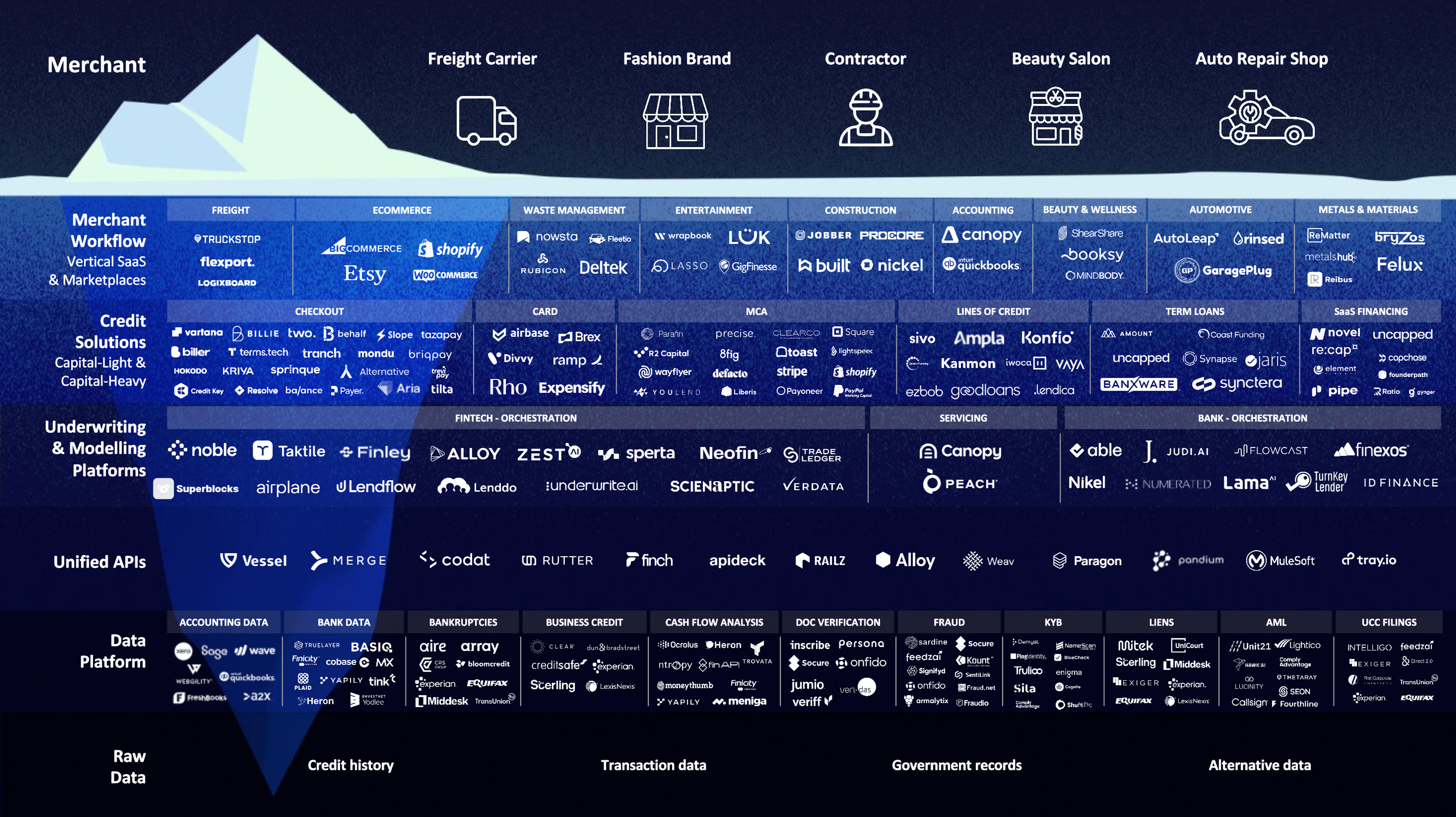

We think about this ecosystem as an iceberg - while a merchant has a seamless experience with an embedded loan "above the surface," there's a much larger world below making that experience possible:

Market Map

Embedded Finance

It’s hard to overstate the momentum in this space - or the mission, which increasingly looks less like old school finance and more like building the future of commerce. Consider how software (and particularly the internet) revolutionized shopping. No more waiting for stores to open. Always finding what you needed. The result? Less friction, more commerce. Embedded finance is no different. By harnessing data flows to power real-time, personalized offers for financial products, we can unlock whatever end-transaction we - or our customers - are trying to make. Again: less friction, more commerce.

As for momentum: 10 years ago, 90% of the logos above didn’t exist. 20 years ago, none of them did. Though much of the market is already mature (particularly the Data Platforms and Credit & Charge Cards layers), there are white spaces abound, with much room for innovation.

The question, then, is what will the market look like in one year? Or ten?

At Activant, we believe the scale of the opportunity has never been greater. Herein, we present a guide to seize on the current moment: where to build, how to build, and why.

Where to play

The “great white whale” of embedded finance: B2B

If you shop online, you’ve likely interacted with (or at least seen) embedded finance, most commonly in the form of the Buy Now, Pay Later button that has become all but ubiquitous during online checkout. Though just one example, today, the vast majority of embedded finance products are B2C, owing to a buying journey that is simpler and far easier to digitize.

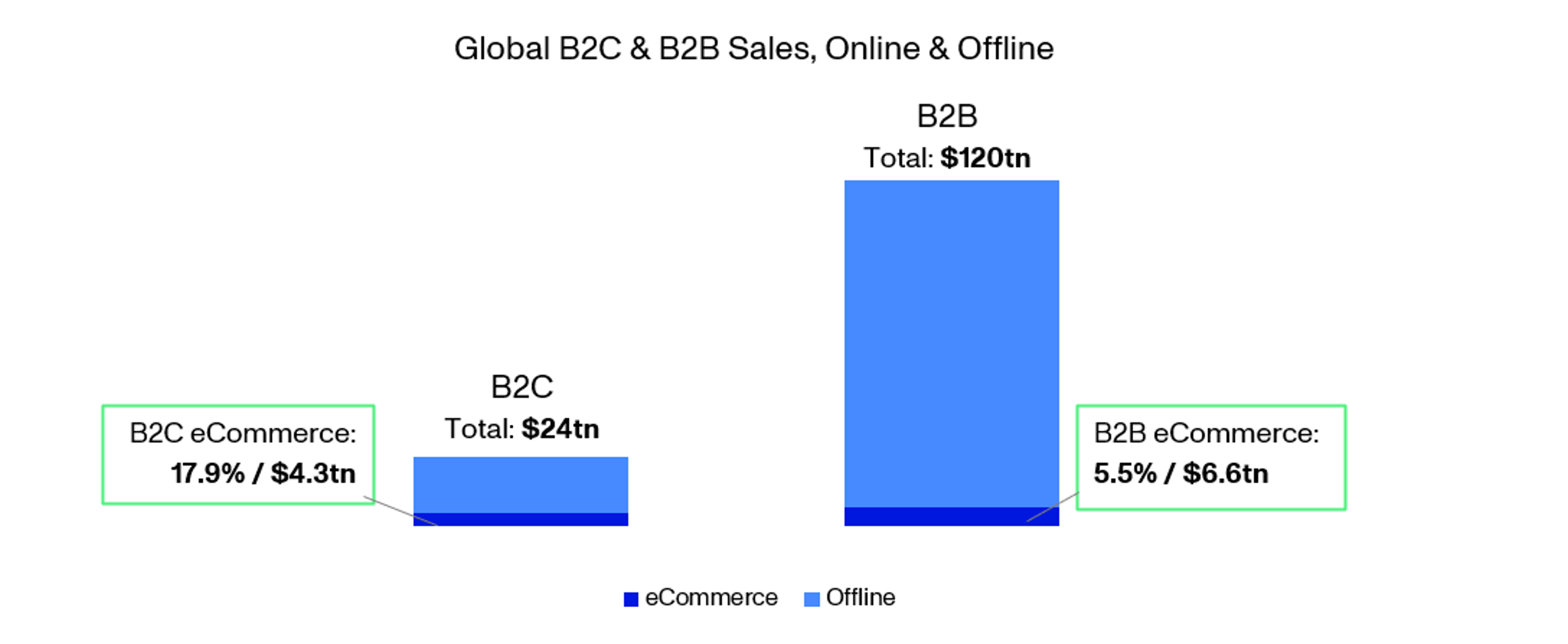

For all B2C’s success, however, the “great white whale” of embedded finance is undoubtedly B2B. Most B2B sales are for huge ($100K - $1M+), mission-critical purchases, for which financing is not an option, but a fundamental requirement. Contrast that with a shirt from Zara, and it comes as no surprise that B2B is where all the money is: $120T annually, versus $24T for B2C:

Research

Global B2C and B2B Sales, Online and Offline

Source: Statista - B2B eCommerce - In-depth Market Insights & Data Analysis

$120T

in B2B sales vs. $24T for B2C

Put simply, much of that is up for grabs.

Though we no longer work via paper mail or fax, B2B is still fundamentally offline. Transactions may be digital, in that they are mediated by email or entered into ERP systems. But the payment processes themselves are largely the same as they were 10 or 20 years ago: you call the bank, provide them with wire information, and authorize the transfer of funds. Imagine doing this every time you wanted to buy something on Amazon, and the difference between digital and online becomes painfully clear. Solve this, and you’re looking at not just a durable lead in the market, but a chance to transform the entirety of B2B.

This is far from hyperbole. What kills most businesses (82%, in fact) is not their product quality, demand, or cost structure, but cash flow. The problem is almost always one of time - how to navigate periods when you’re holding inputs or finished goods, but before revenue is generated. Those inside the company can see that eventually, the math will work out. But for a multitude of reasons, traditional finance struggles to keep up. This is the power of bringing credit directly into a company’s operating system, be it Square, Shopify, or any other system of record. We can ease this friction, or eliminate it altogether.

Why, then, is it still anyone’s game? The answer is equal parts people and tech. For one, legacy businesses are slow to adapt. Decision makers are typically older, and not versed in the technologies underlying embedded finance. Building consensus is hard. Also, there are legacy workflows and systems to consider, most of which are unwieldy, but have been bolted into place for years.

The psychology of buyer behavior is also markedly different at a B2B scale. While a consumer may feel comfortable buying a $50-100 product online, a business will certainly think twice before spending $100K.

Truthfully, though, it’s the tech that’s the hard part. The B2B buying journey is complicated, and myriad pieces need to come together to execute real-time underwriting based on the macro (and micro) environment.

After years of growth, however, the embedded finance ecosystem has finally reached a critical mass — giving us just enough pieces to glimpse the finished puzzle.

The trick is building for omnichannel

Unlike B2C, a B2B purchase unfolds across a variety of spaces, from email and websites to trade shows and phone calls. No two transactions are the same; they’re nuanced, high touch, and hard to digitize. Put simply, there’s a reason we’re still waiting for a “Shopify for B2B.”

This same reason is why we also pay great salespeople so well. After all, this is exactly what they do today. Rather than push products, a great salesperson unlocks or solves problems, guiding their customers to solutions that add value - whether by putting out fires, or enabling future growth. Doing this well is inherently omnichannel, and means knowing the business inside and out.

The promise - and challenge - of embedded finance is to move all of this into software in a way that enhances the ability to serve the customer. It’s not about merely extending credit, but reducing the friction between problems and solutions in B2B.

What would such a platform even look like? What kind of buying journey would it enable?

In many ways, the hope is to close the gap between B2C and B2B, but with a twist: early on, B2B buyers would learn not just if a product is right for them, but if it’s right for them financially. Combining a variety of on- and offline data, software would answer questions like: Can I afford this thing? How would it affect my profitability this year? In the next five years? How long will it take me to pay it off? Should I lease or buy?

Today, these answers are provided by a person, with all the benefits (and baggage) that entails. To succeed, software must do the same, but instantly, across channels, and with more and better data.

How to Play

Remember: the value is in the software, not the financing

For the past decade, capital was cheap. A lot of companies grew rapidly, offering competitive lines of credit to their customers. Most differentiated based on distribution - going to where the customer was - which they cited as the basis for a slight markup over bank rates. To the extent that their offering was online, it was often a thin digital layer on top of financing, while money was the real product.

As recent history has shown, this is hardly a durable advantage. Rates change, and more importantly, you’ll never be as cheap as the bank. Instead, leaders in this space are putting the technology first, weaving themselves into their customer’s workflow.

Unlike their predecessors, these companies realize that the “embedded” part of embedded finance is where the value is, and that if you have incredible software, you can serve anyone a relevant financial product, cheaply and without human intervention - because you understand their risk.

Platforms like Middesk have built foundational data infrastructure to help embedded lending tools better assess the risks of underwriting businesses:

B2B commerce is complicated. Our goal is to help our partners reduce the time spent gathering essential data, so they can instead prioritize building the best industry-relative workflow solutions."

Kyle Mack, Co-Founder & CEO, Middesk

The lesson: build software that makes the B2B transaction better, and you can offer financial services when they’re needed most.

This is not to say financing is unimportant. If you’re unable to serve up compelling financial products, then you’re just building software for the sake of building software, which is ok, but a different business and vision. Instead, aim to bring software and financing together, while keeping the former the secret sauce.

Using Wallet Share as a North Star

One framework we find helpful is to consider your "share of wallet." As an embedded fintech platform, how much of your customer's capital flows do you have visibility into, or better yet, power entirely?

This is an important measure of how deeply your platform is integrated. The more share of wallet you have, the more mission-critical your product, the more value your customer receives, and the more durable your revenue becomes. This also helps avoid adverse risk selection, which is especially important for many B2B lending platforms.

Ultimately, increasing wallet share directly tied to our end goal – becoming more "workflow" and less "finance" over time. Embedded finance is one the most powerful wedges into B2B commerce flows, and by tapping into the full flow of funds embedded players can earn the right to expand horizontally and build a broader B2B commerce automation platform, even in markets that have high barrier to entry.

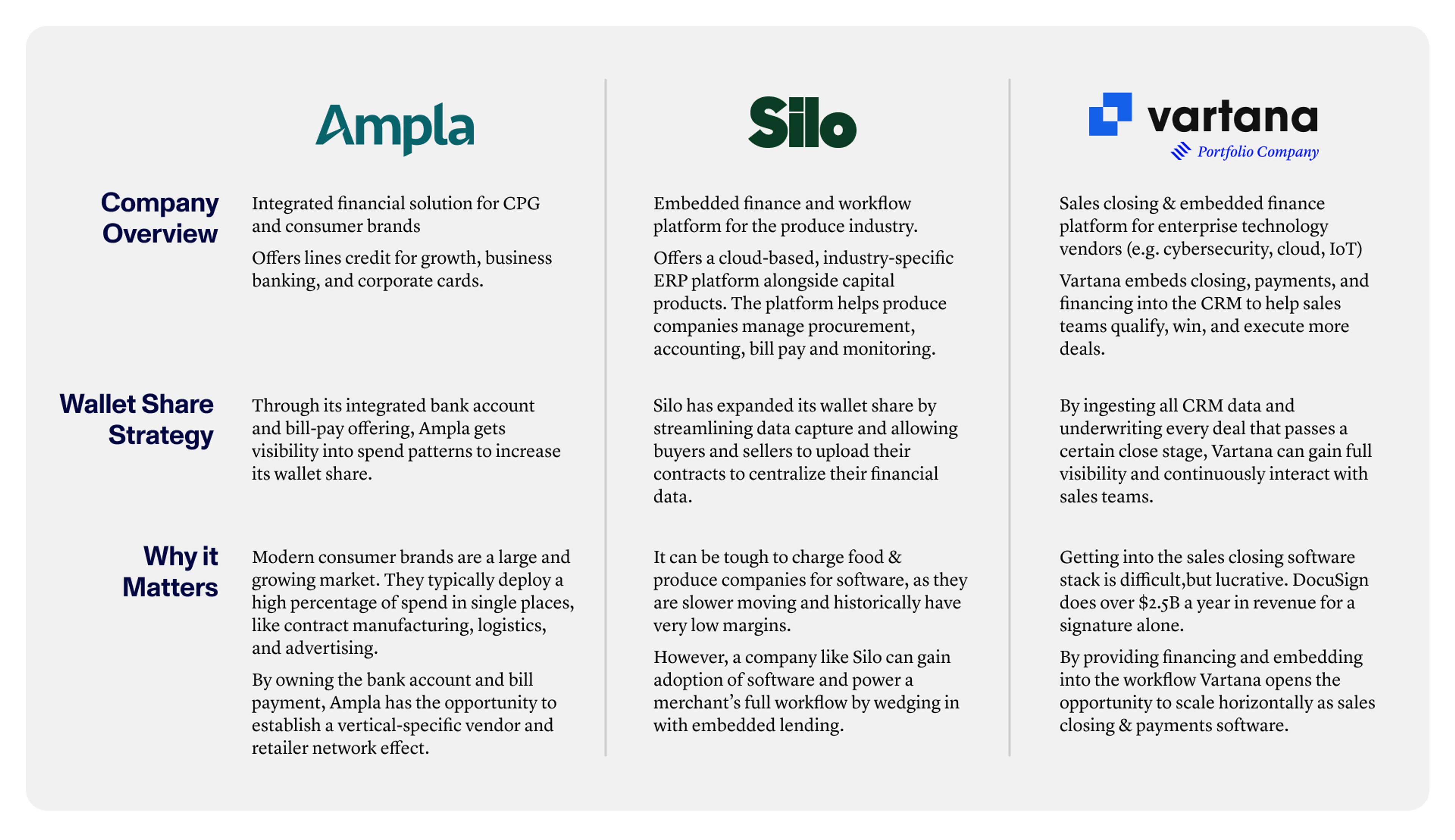

There isn't a single playbook here, but below are a few examples we've seen from the Activant portfolio and beyond:

Case Study

Increasing Share of Wallet

Don’t make it snazzy - make it easy

We’re aware: the above is certainly no small feat. So it's critical for builders to shrink the challenge where they can.

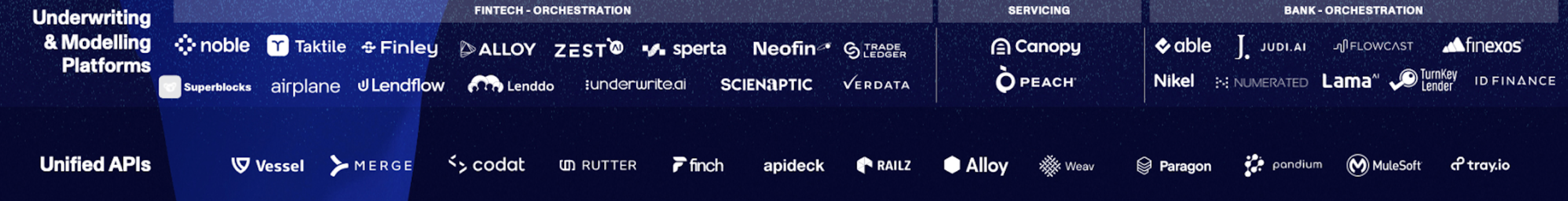

To start, take advantage of the other platforms in the Embedded Finance Ecosystem. Of particular note from are Underwriting & Modeling Platforms and Unified APIs:

The former reduce the time required to launch a compliant and wholistic embedded lending product.

Within this category, companies often concentrate on a particular section of underwriting. Canopy Servicing and Peach Finance, for example, are focused primarily on loan servicing workflows:

By maintaining a servicing relationship through the Canopy platform, our customers can keep their customers engaged across the full loan lifecycle, opening up the opportunity for upsell and stickier relationships."

Matt Bivons, Founder & CEO, Canopy Servicing

While Taktile, Noble, Lendflow, and Alloy are primarily focused on the opposite side of a loan - origination:

And Unified APIs like Finch, Rutter, Alloy (the other one!), Codat, and more serve as middleware to easily connect data sources and platforms, so you and your team don't have to:

Taktile’s decision engine harnesses the power of data by giving customers the ability to use their partners’ proprietary data and combine it with third-party data to offer highly verticalized lending products, such as a "care now pay later" solution."

Maik Taro Wehmeyer, Co-Founder & CEO, Taktile

Stay tuned for our follow up piece in this area breaking down the key traits and characteristics of each player in these enablement layers. Also check out our low-code / no-code piece featuring leaders like Airplane and Superblocks that can be leveraged across fintech here.

Together, we can unlock the future of embedded finance

There’s no denying: solving this is hard, and we don’t have all the answers. But the vision and potential are undoubtedly clear.

At Activant, we’re excited by those shaping the future of embedded finance, and with it, commerce as a whole. To be sure, much progress has been made - but we’re still very much at the beginning of this opportunity. We can’t wait to see the rest, and hope you’ll join us as we help build it.

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.